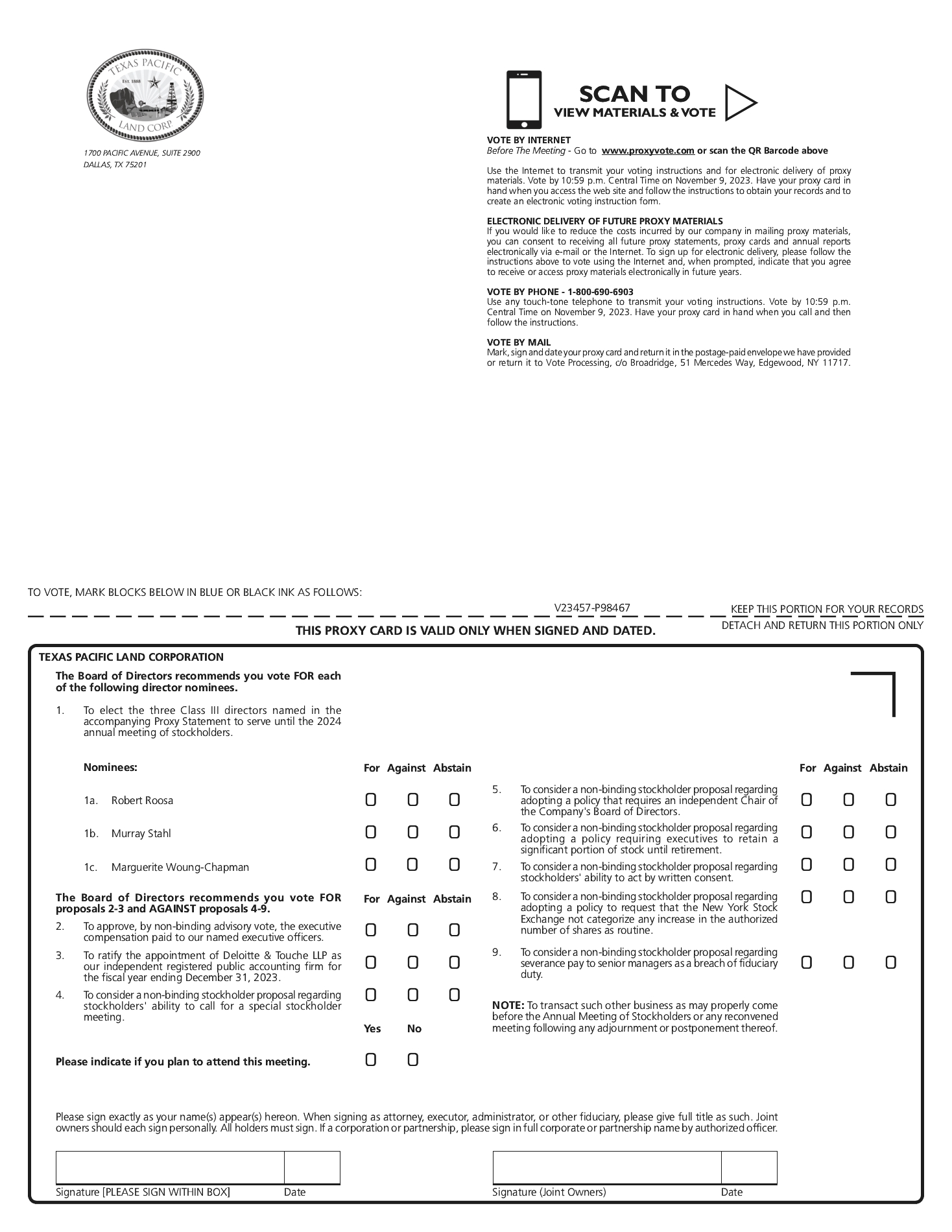

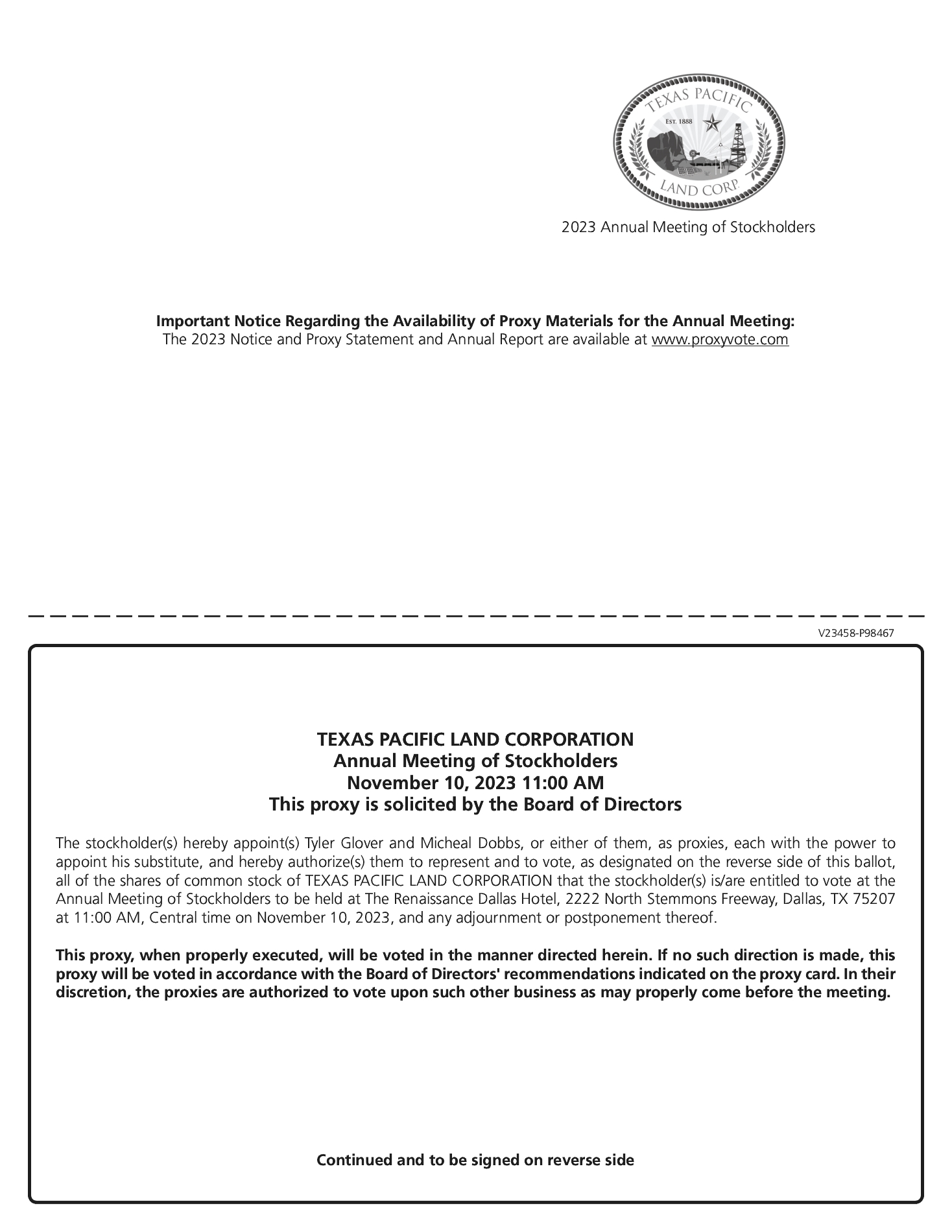

Bonus for the year in which the change in control occurs. If Mr. Glover’s

employment terminates due to death or disability, he or his estate will be entitled to the benefits described in clauses (i), (ii) and (iii) above. Mr. Glover will also be entitled to payment of accrued but unpaid salary, accrued but unused

vacation, unsubsidized COBRA benefits, and unreimbursed business expenses, following termination of employment for any reason.

The A&R Glover Employment Agreement provides that Mr. Glover will be entitled

to participate in all benefit plans provided to the Company’s executives of like status from time to time in accordance with the applicable plan, policy or practices of the Company, as well as in any long-term incentive program established by

the Company. It also provides for four weeks of annual paid vacation, reimbursement of business expenses, and indemnification rights.

The A&R Glover Employment Agreement contains restrictive covenants prohibiting

Mr. Glover from disclosing the Company’s confidential information at any time, from competing with the Company in specified counties where the Company does business during his employment, subject to certain exceptions, and for one year

thereafter (or six months thereafter if he terminates his employment voluntarily without good reason), and from soliciting the Company’s clients, suppliers and business partners during his employment and for one year thereafter.

Mr. Steddum

On August 8, 2019, Mr. Steddum and the Company entered into an Employment Agreement

(the “Steddum Agreement”). Pursuant to the Steddum Agreement, Mr. Steddum received a base salary of $450,000 per annum, subject to annual review, and was eligible for an annual cash bonus of up to 150% of such base salary for achievement of

specified performance targets as established by the Compensation Committee. Mr. Steddum was also eligible for a relocation allowance of $75,000 to cover his expenses in connection with his move to Dallas. The term of the Steddum Agreement ends

on December 31, 2022, with automatic one (1) year extensions unless notice not to renew is given by either party at least 120 days prior to the relevant end date.

The Steddum Agreement provided for payment of severance benefits if the officer’s

employment was terminated by the Company without cause or by Mr. Steddum for good reason, provided that Mr. Steddum executed a general waiver and release of claims and complied with the restrictive covenants described below. The severance

benefits included (i) accrued but unpaid bonuses and vested long-term incentive benefits (ii) a pro rata bonus for the year of termination (if such termination occurs after the first calendar quarter), (iii) up to 12 months of COBRA premiums

for continued group health, dental and vision coverage for the officer and his dependents, paid for by the Company, and (iv) an amount equal to one times the average of his base salary and cash bonus for the preceding two years. If

Mr. Steddum’s employment was terminated by the Company without cause, by the officer for good reason, or upon failure of the Company to renew the term of the Agreement, in all such cases, within 24 months following a change in control of the

Company as defined in the Steddum Agreement, then, in lieu of the amount specified in clause (iv), Mr. Steddum would be entitled to an amount equal to 1.5 times the greater of (a) the average of his base salary and cash bonus for the two years

preceding the change in control and(b) his base salary and target cash bonus for the year of the change in control. If Mr. Steddum’s employment terminates due to death or disability, he would be entitled to the benefits described in clauses (i)

and (ii) above. Mr. Steddum would also be entitled to payment of accrued but unpaid salary, accrued but unused vacation, unsubsidized COBRA benefits, and unreimbursed business expenses following termination of employment for any reason.

On February 8, 2022, the Company and Mr. Steddum entered into an Amended and

Restated Employment Agreement (the “A&R Steddum Employment Agreement”). The A&R Steddum Employment Agreement replaces the previous employment agreement between TPL and Mr. Steddum.

Pursuant to the A&R Steddum Employment Agreement, Mr. Steddum receives a base

salary of $475,000 per annum, subject to annual review (pursuant to which base salary is currently $500,000), and shall also be eligible for an annual bonus (“Bonus”) based on achievement of specified performance targets as established by the

Compensation Committee of the Board of Directors. For 2021, Mr. Steddum is eligible for a target annual Bonus of 225% of his base salary (“2021 Bonus”) which shall be paid in cash, provided that 25% of the after-tax amount of the 2021 Bonus may

be paid in Common Stock. For years after 2021, Mr. Steddum’s target annual Bonus will be at least 90% of his base salary and will be payable in cash. For years after 2021, Mr. Steddum will also