UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE l4A

(Rule 14a-101)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement | |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

|

☒ |

Definitive Proxy Statement | |

|

☐ |

Definitive Additional Materials | |

|

☐ |

Soliciting Material Under Rule l4a-l2 |

TEXAS PACIFIC LAND TRUST.

(Name of Registrant As Specified In Its Charter)

|

N/A |

|

(Name of Person(s) Filing Proxy statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. | |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |

|

(1) |

Title of each class of securities to which transaction applies: | |

|

(2) |

Aggregate number of securities to which transaction applies: | |

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth in the amount on which the filing fee is calculated and state how it was determined): | |

|

(4) |

Proposed maximum aggregate value of transaction: | |

|

(5) |

Total fee paid: | |

|

☐ |

Fee paid previously with preliminary materials. | |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a) (2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

|

(1) |

Amount Previously Paid: | |

|

(2) |

Form, Schedule or Registration Statement No.: | |

|

(3) |

Filing Party: | |

|

(4) |

Date Filed: |

TEXAS PACIFIC LAND TRUST

1700 Pacific Avenue

Suite 2770

Dallas, Texas 75201

December 7, 2016

To All Holders of Sub-share Certificates of

Proprietary Interest (“Sub-share Certificates”):

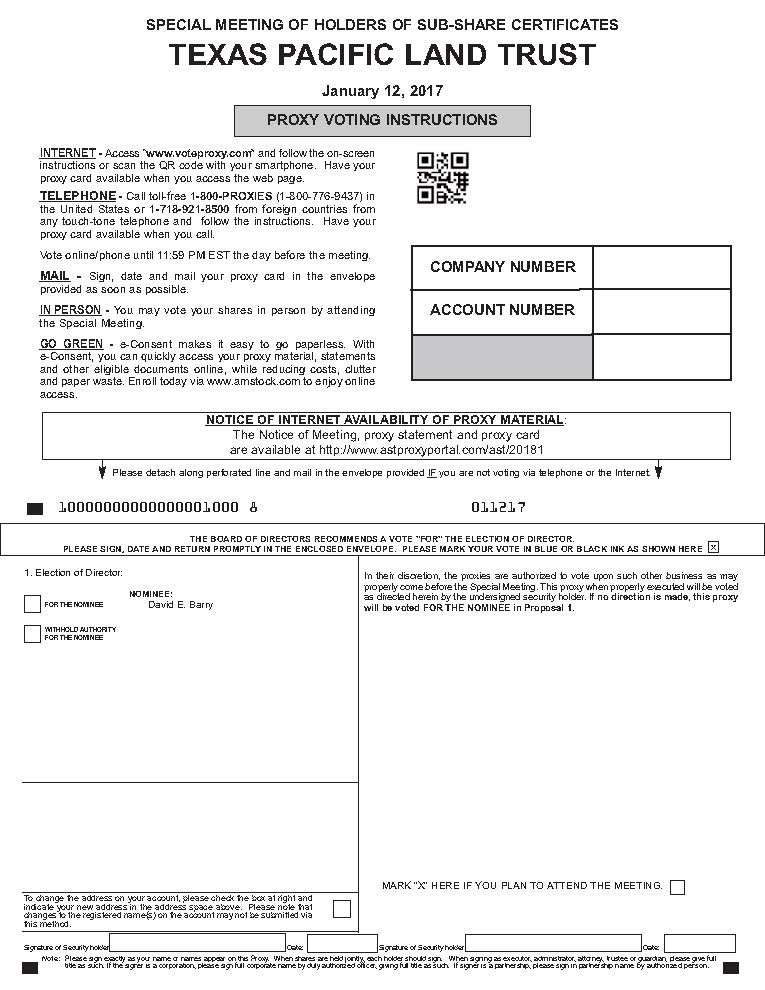

You are cordially invited to attend a special meeting of Holders of Sub-share Certificates which will be held at The Ritz-Carlton, 2121 McKinney Avenue, Cypress Room, Dallas, Texas 75201, on Thursday, January 12, 2017, at 10:00 A.M., Dallas time. Official notice of the Special Meeting, Proxy Statement and form of Proxy are enclosed with this letter. The purpose of the Special Meeting is to elect a Trustee to the Texas Pacific Land Trust to succeed Mr. James K. Norwood, who passed away on September 27, 2016.

The Trustees of the Texas Pacific Land Trust are only three in number and they are selected until their resignation or death or removal for cause. Thus, we have given very considerable time and thought to our suggestion for a successor Trustee. We are gratified to have secured the consent of Mr. David E. Barry to become a candidate for Trustee.

Mr. Barry was born in New York City in 1945. He graduated from the College of the Holy Cross in 1966 with a degree in Physics and from Harvard Law School in 1969. Mr. Barry began his career at the law firm of Kelley Drye & Warren LLP in 1969, becoming a partner on January 1, 1978. He spent his entire career at this firm, including representing the Trust for many years, until he became a retired partner in 2012. Beginning in 2007 and then full time starting in 2012, Mr. Barry worked as President of Sidra Real Estate, Inc., a former client with commercial real estate holdings throughout the United States. In addition, in 2012 and 2014, Mr. Barry became President of Tarka Resources, Inc. and Tarka, Inc., respectively, both of which are involved in oil and gas exploration in Texas, Oklahoma and Louisiana and which firms merged on November 18, 2016 into Tarka Resources, Inc. Mr. Barry is a member of the bar of New York State and retired as a member of the bar of the State of Connecticut.

If you cannot be present at the meeting, please complete, sign and return the Proxy in the enclosed envelope so that your Sub-share Certificates may be represented.

|

|

Maurice Meyer III |

|

|

Chairman of the Trustees |

TEXAS PACIFIC LAND TRUST

_____________________

Notice of Special Meeting of Holders of

Sub-share Certificates of Proprietary Interest

(“Sub-share Certificates”) to be Held January 12, 2017

_____________________

|

To: |

The Holders of Sub-share Certificates issued under a certain Declaration of Trust made by Charles J. Canda, Simeon J. Drake and William Strauss, dated February 1, 1888: |

NOTICE IS HEREBY GIVEN that due to the death of Mr. James K. Norwood, one of the Trustees under the Declaration of Trust, the Trustees, and in accordance with the provisions of the Declaration of Trust, have called a Special Meeting of the Holders of Sub-share Certificates to be held at The Ritz-Carlton, 2121 McKinney Avenue, Cypress Room, Dallas, Texas 75201, on Thursday, January 12, 2017, at 10:00 A.M., Dallas time, for the purpose of electing a Trustee in the place of Mr. James K. Norwood, and transacting such other business as may properly come before the meeting.

Notice of the meeting will be published as required by the Declaration of Trust.

The record date for determining Holders of Sub-share Certificates entitled to notice of or to vote at the special meeting is December 6, 2016. Therefore, only Holders of Sub-share Certificates whose names shall have been registered on December 6, 2016 will be entitled to vote.

If you do not intend to be present at the meeting in person, but wish to vote upon the matters to come before the meeting, please sign the accompanying proxy and return the same to Texas Pacific Land Trust, care of the American Stock Transfer & Trust Co. in the enclosed envelope.

|

|

Maurice Meyer III John R. Norris III |

|

|

As Trustees under the above-mentioned Declaration of Trust |

Dallas, Texas

December 7, 2016

Please Date, Sign and Return the Accompanying Proxy

TEXAS PACIFIC LAND TRUST

1700 Pacific Avenue

Suite 2770

Dallas, Texas 75201

____________________

PROXY STATEMENT

____________________

GENERAL

Messrs. Maurice Meyer III and John R. Norris III, the Trustees under the Declaration of Trust dated February 1, 1888, made by Charles J. Canda, Simeon J. Drake and William Strauss (hereinafter sometimes called the Texas Pacific Land Trust or the Trust), solicit a proxy from you for a Special Meeting of the Holders of the Sub-share Certificates of Proprietary Interest (“Sub-share Certificates”) issued and outstanding under said Declaration of Trust to be held at The Ritz-Carlton, 2121 McKinney Avenue, Cypress Room, Dallas, Texas 75201, on January 12, 2017, at 10:00 A.M., Dallas time. You may, if you should so desire, revoke the proxy at any time before it shall have been taken into account or voted by submitting a revised one at any time before the vote to which the proxy relates or by submitting a ballot at the Special Meeting. All Sub-share Certificates represented by proxies in the accompanying form will be voted.

Texas Pacific Land Trust has borne the cost of approximately $5,000 of preparing, assembling and mailing this proxy statement, the attached notice, and the accompanying proxy and return envelope. We have engaged Georgeson LLC (“Georgeson”) as paid solicitors in connection with the Special Meeting. Georgeson will be paid to solicit proxies and distribute proxy materials to nominees, brokers and institutions. The anticipated cost of such service is approximately $7,500.

The record date for determining Holders of Sub-share Certificates entitled to notice of or to vote at the special meeting is December 6, 2016. Therefore, only Holders of Sub-share Certificates whose names shall have been registered on December 6, 2016 will be entitled to vote.

As of December 6, 2016, there are 7,929,780 outstanding Sub-share Certificates of the par value of $.03-1/3 each. The Sub-share Certificates are entitled to one vote each.

The approximate date on which this Proxy Statement and the form of proxy included herewith, together with our Annual Report on Form 10-K, are being first sent to Holders of Sub-share Certificates is December 7, 2016. The Annual Report, which is included with this Proxy Statement, is not a part of the proxy solicitation materials. Upon receipt of a written request, the Trust will furnish to any stockholder, without charge, an additional copy of such Annual Report. Any such written request should be directed to the Trust’s Secretary at 1700 Pacific Avenue, Suite 2770, Dallas, Texas 75201 or (214) 969-5530. These documents are also included in our filings with the Securities and Exchange Commission (the “SEC”), which you can access electronically at the SEC's website at http://www.sec.gov.

ELECTION OF TRUSTEE

The Declaration of Trust provides for three Trustees. Since 2006, these Trustees have been Messrs. Maurice Meyer III, John R. Norris III and James K. Norwood. The Trustees perform the duties usually performed by member of the Board of Directors. They hold office until death, resignation or disqualification. Mr. Meyer is currently Chairman of the Trustees. Mr. David Peterson has been General Agent, Chief Executive Officer and Secretary of the Trust since January 1, 2014. Mr. Tyler Glover has been Assistant General Agent since December 1, 2014. Mr. Robert J. Packer has been Chief Financial Officer of the Trust since December 1, 2014.

David Peterson, who had been General Agent, Chief Executive Officer and Secretary of the Trust since January 1, 2014, resigned as such effective November 4, 2016. Effective November 5, 2016, Tyler Glover, who was then serving as Assistant General Agent since December 1, 2014, was named Co-General Agent, Chief Executive Officer and Secretary, and Robert J. Packer, who was then serving as Chief Financial Officer since December 1, 2014, was named as Co-General Agent and Chief Financial Officer.

Mr. James K. Norwood passed away on September 27, 2016. The Declaration of Trust provides that in the event of the death, resignation or disqualification of any of the Trustees a successor Trustee shall be elected at a Special Meeting of the Holders of Sub-share Certificates by a majority in the amount of the Holders of Sub-share Certificates present in person or by proxy at such meeting whose names shall have been registered in the books of the Trustees at least fifteen days before such meeting. The Trustees decided that January 12, 2017 is the date of the special meeting and that December 6, 2016 is the record date therefor. Accordingly, only Holders of Sub-share Certificates whose names are registered on December 6, 2016 will be entitled to vote at the special meeting.

The Trustees and the persons named in the accompanying proxy intend that if you execute and return your proxy with an affirmative response such persons shall cast their votes for the election of Mr. David E. Barry as a Trustee.

Certain information about the nominee for Trustee is set forth below.

Mr. Barry was born in New York City in 1945. He graduated from the College of the Holy Cross in 1966 with a degree in Physics and from Harvard Law School in 1969. Mr. Barry began his career at the law firm of Kelley Drye & Warren LLP in 1969, becoming a partner on January 1, 1978. He spent his entire career at this firm, including representing the Trust for many years, until he became a retired partner in 2012. Beginning in 2007 and then full time starting in 2012, Mr. Barry worked as President of Sidra Real Estate, Inc., a former client with commercial real estate holdings throughout the United States. In addition, in 2012 and 2014, Mr. Barry became President of Tarka Resources, Inc. and Tarka, Inc., respectively, both of which are involved in oil and gas exploration in Texas, Oklahoma and Louisiana and which firms merged on November 18, 2016 into Tarka Resources, Inc. Mr. Barry is a member of the bar of New York State and retired as a member of the bar of the State of Connecticut. We believe Mr. Barry’s long history with the Trust, as well as his real estate and oil and gas exploration experience, will bring valuable experience, insight and institutional knowledge to the Trustees. Mr. Barry qualifies as “independent” within the meaning of the rules of the New York Stock Exchange.

INFORMATION ABOUT THE TRUSTEES AND MANAGEMENT

The Trustees of the Trust met four times in 2015. All of the Trustees attended at least 75% of those meetings, and of meetings of committees (discussed below) on which they served.

Holders of Sub-share Certificates may contact a Trustee or the Trustees as a group, by the following means:

Mail: Texas Pacific Land Trust

1700 Pacific Avenue, Suite 2770

Dallas, Texas 75201

Phone: (214) 969-5530

Email: robert@tpltrust.com

Each communication should specify the applicable addressee or addressees to be contacted as well as the general topic of the communication. The Trust will initially receive and process communication before forwarding them to the addressee. The Trust generally will not forward to the Trustees a communication if it determines to be primarily commercial in nature, that relates to an improper or irrelevant topic, or that requests general information about the Trust.

The following tables and the notes appended hereto set forth information with respect to each other person who is a Trustee or executive officer of the Trust, the name of each such person, all positions and offices with the Trust presently held, his present principal occupation or employment, and the date on which he first became a Trustee or an officer.

Trustees

|

Name |

Age |

Position and Offices Held With Registrant |

Period During Which | ||||

|

|

|

|

| ||||

|

Maurice Meyer III |

80 |

Trustee, Chairman of the Trustees, Chairman of Audit Committee and Member of Nominating, Compensation and Governance Committee |

Trustee since February 28, 1991; Chairman of Trustees since May 28, 2003. | ||||

|

|

|

|

| ||||

|

John R. Norris III |

62 |

Trustee and Member of Nominating, Compensation and Governance Committee |

Trustee since June 7, 2000. | ||||

We believe Mr. Meyer’s qualifications to serve as a Trustee include the wealth of knowledge and understanding concerning the Trust which he has gained in his twenty-five (25) years of service as a Trustee. In addition, prior to his retirement, he spent his entire career in the securities industry which enables him to bring particularized expertise to provide guidance and assistance to management in administering the Trust’s Sub-share repurchase program prescribed by the terms of the Declaration of Trust.

We believe Mr. Norris’ qualifications to serve as a Trustee include his legal expertise and extensive background as a practicing attorney in Dallas which allows him to provide counsel and insight to his fellow Trustees and management with respect to the various legal issues which the Trust faces. In addition to his sixteen (16) years of experience as a Trustee, Mr. Norris advised the Trust on legal matters for many years prior to his election as a Trustee.

Executive Officers

|

Name |

Age |

Position and Offices Held With Registrant |

Period During Which Person Has Served in Office |

| |||

|

|

|

|

|

|

|

| |

|

Tyler Glover |

|

31 |

|

Co-General Agent, Chief Executive Officer and Secretary |

|

Co-General Agent, Chief Executive Officer and Secretary as of November 5, 2016. Assistant General Agent of the Trust from December 1, 2014 through November 5, 2016. Mr. Glover had previously served as field agent for the Trust from September 2011 through December 1, 2014. |

|

|

|

|

|

|

|

|

|

|

|

Robert J. Packer |

|

47 |

|

Co-General Agent and Chief Financial Officer |

|

Co-General Agent as of November 5, 2016. Chief Financial Officer of the Trust as of December 1, 2014. Mr. Packer had previously served as Accounting Supervisor from March 21, 2011 through December 1, 2014. |

|

The Trustees hold office until their death, resignation or disqualification. The Co-General Agent, Chief Executive Officer and Secretary and the Co-General Agent and Chief Financial Officer hold office until their death, resignation, discharge or retirement pursuant to the Texas Pacific Land Trust Revised Employees’ Pension Plan. No Trustee or executive officer was selected to be an officer pursuant to any arrangement or understanding between him and any other person or persons other than the Trustees acting solely in their capacity as such.

Certain Significant Employees. The Trust does not employ any person who is not an executive officer who makes or is expected to make significant contributions to the business of the Trust.

Family Relations. There are no family relationships among any of the Trustees and executive officers of the Trust.

Business Experience.

|

Name of Trustee or |

|

Principal Occupation or Employment |

|

|

|

|

|

Maurice Meyer III |

|

Former Vice Chairman of Henderson Brothers; personal investments |

|

|

|

|

|

John R. Norris III |

|

Attorney; Calloway, Norris, Burdette & Weber, PLLC, Dallas, Texas |

|

|

|

|

|

Tyler Glover |

|

Co-General Agent, Chief Executive Officer and Secretary as of November 5, 2016; Assistant General Agent of the Trust from December 1, 2014 through November 5, 2016; field agent for the Trust from September 2011 through December 1, 2014. |

|

|

|

|

|

Robert J. Packer |

|

Co-General Agent as of November 5, 2016; Chief Financial Officer of the Trust as of December 1, 2014; Accounting Supervisor of Texas Pacific Land Trust from March 2011 through December 1, 2014. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Trustees, the Trust’s executive officers and persons who beneficially own more than 10% of its Sub-share Certificates to file reports of ownership and changes in ownership with the Commission and to furnish the Trust with copies of all such reports they file. Based on the Trust’s review of the copies of such forms received by it, or written representations from certain reporting persons, the Trust believes that none of its Trustees, executive officers or persons who beneficially own more than 10% of the Sub-share Certificates failed to comply with Section 16(a) reporting requirements in 2015.

Code of Ethics

The Trust has adopted a Code of Conduct and Ethics applicable to its Chief Executive Officer, Chief Financial Officer and certain other employees. A copy of the Code of Ethics has been made available on the Trust’s corporate website. We maintain our website at http://www.TPLTrust.com.

Changes in Procedures Regarding Nomination of Trustees

There have been no material changes to the procedures by which security holders may recommend nominees to the Trust’s Board of Trustees. The Trust has a standing Nominating, Compensation and Governance Committee. The current members of the Nominating, Compensation and Governance Committee are Messrs. Meyer and Norris, with a vacancy created by Mr. Norwood’s death. The Nominating, Compensation and Governance Committee has adopted a formal written charter (the “Nominating, Compensation and Governance Charter”). The Nominating, Compensation and Governance Committee is responsible for identifying and evaluating potential trustees in the event that a vacancy arises, determining compensation of the Trustees and the executive officers, and overseeing corporate governance matters. The Nominating, Compensation and Governance Charter is available on the Trust’s Internet website at http://www.TPLTrust.com.

INFORMATION ABOUT THE COMMITTEES

The Trust has standing Audit, Pension and Nominating, Compensation and Governance Committees.

Audit Committee

The Trust has a standing Audit Committee of its Board of Trustees and met twice in 2015. The current member of the Audit Committee is Mr. Meyer, with a vacancy created by Mr. Norwood’s death. The Audit Committee has adopted a formal written charter (the “Audit Charter”). The Audit Committee is responsible for ensuring that the Trust has adequate internal controls and is required to meet with the Trust’s auditors to review these internal controls and to discuss other financial reporting matters. The Audit Committee is also responsible for the appointment, compensation and oversight of the auditors. Mr. Meyer qualifies as “independent” within the meaning of the rules of the New York Stock Exchange. The Audit Charter is available on the Trust’s Internet website at http://www.TPLTrust.com.

Audit Committee Financial Expert

The Board of Trustees has determined that no current member of the Board of Trustees serving on the Trust’s Audit Committee would meet the requirements of the definition of “audit committee financial expert” set forth in the applicable rules of the SEC. The terms of the Trust, which was established in 1888, and governing law would require an amendment of the Trust in order to add new Trustees who would satisfy the requirements of the definition. Any amendment of the Trust to do so would necessarily involve judicial proceedings and an expensive time-consuming process with no assurance that an individual meeting the requirements of the definition, who would be willing to serve as Trustee given the modest compensation offered ($2,000 per annum, $4,000 per annum for the Chairman), could be located. The Audit Committee consists of one independent Trustee, with a vacancy created by Mr. Norwood’s death, who has been determined by the Trustees to be qualified, in his judgment, to monitor the performance of management, the Trust’s internal accounting operations and the independent auditors and to be qualified to monitor the disclosures of the Trust. In addition, the Audit Committee has the ability to retain its own independent accountants, attorneys and other advisors, whenever it deems appropriate, to advise it. As a result, the Trustees believes that the time and expense involved in an amendment of the Trust, with no assurance that an individual meeting the requirements of the definition of “audit committee financial expert” could be persuaded to become a Trustee, would not be in the best interests of the Trust at this time.

Pension Committee

The Pension Committee is comprised of all of the Trustees, and met once in 2015. The Pension Committee meets annually to oversee the administration of pension benefits for the employees of the Trust.

Nominating, Compensation and Governance Committee

The Nominating, Compensation and Governance Committee (“Nominating and Compensation Committee”) has been established by the Trustees to assist the Trustees in discharging and performing the duties and responsibilities of the Trustees with respect to corporate governance, management compensation, succession planning and employee benefits. The Nominating and Compensation Committee consists of all of the Trustees and met twice in 2015. Each member qualifies as “independent” within the meaning of the rules of the New York Stock Exchange. The Nominating and Compensation Committee has adopted a written charter (the “Nominating and Compensation Charter”). The Nominating and Compensation Charter is available on the Trust’s Internet website at http://www.TPLTrust.com.

The Nominating and Compensation Committee does not have a formal policy with regard to the consideration of any Trustee candidates recommended by Holders of Sub-share Certificates. The Trustees believe that such a formal policy is unnecessary and that the issue is more appropriately dealt with on a case-by-case basis. When there is a vacancy with respect to a Trustee, the Nominating and Compensation Committee identifies individuals who are qualified and available to serve as Trustees and evaluates many factors, including whether such individuals are independent under the rules of the New York Stock Exchange, the Securities and Exchange Commission (“SEC”) and the Sarbanes-Oxley Act of 2002, and deemed “non-employee directors” under Rule 16b-3 under the Securities Exchange Act of 1934, as amended, and “outside directors” under Section 162(m) of the Internal Revenue Code of 1986 (the “Code”). The Nominating and Compensation Committee recommends to the Trustees such nominees for election as Trustees to fill such vacancy, with the goal of submitting the recommendation to the Holders of Sub-share Certificates. Although there are no specific minimum qualifications that the Nominating and Compensation Committee relies on when evaluating candidates, such candidates should, among other things, possess high degrees of integrity, honesty and literacy in financial and business matters.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Trust’s compensation program is designed to reward the performance of the Named Executive Officers (as defined below) in achieving the Trust’s primary goals of protecting and maintaining the assets of the Trust. The compensation program consists principally of a salary and an annual cash bonus. Base salaries provide our Named Executive Officers with a steady income stream that is not contingent on the Trust’s performance, while the addition of a cash bonus allows the Nominating, Compensation and Governance Committee flexibility to recognize and reward the Named Executive Officers’ contributions to the Trust’s performance in a given year. Salaries are reviewed annually and salary increases and the amounts of cash bonuses are determined by the Nominating, Compensation and Governance Committee of the Trustees based upon an evaluation of the Named Executive Officer’s performance against the goals and objectives of the Trust. Differences in salary for the Named Executive Officers may reflect the differing responsibilities of their respective positions, the differing levels of experience of the individuals and internal pay equity considerations. The Nominating, Compensation and Governance Committee does not have a specific list of factors to which it assigns various weights and against which it measures the Named Executive Officers’ performance in making its compensation decisions. The Committee’s decisions are based on their overall impression of the Named Executive Officers’ individual performances.

The Trust has not incorporated equity-related or other long-term compensation elements in its compensation programs. The Declaration of Trust pursuant to which the Trust was created empowers the Trustees to use the lands originally contributed to the Trust either to pay dividends to the certificate holders or to repurchase and cancel outstanding certificates. In view of that general directive to the Trustees, the issuance of equity to executive officers has not been made a part of the Trust’s compensation program.

As part of its compensation program the Trust maintains both a qualified defined benefit pension plan and a qualified defined contribution plan which are both available to employees generally, as well as the Named Executive Officers. These plans are designed to assist employees in planning adequately for their retirement.

The Nominating, Compensation and Governance Committee has the sole authority to determine the compensation of the Co-General Agent, Chief Executive Officer and Secretary and the Co-General Agent and Chief Financial Officer of the Trust.

Since the Trust was not required to, and did not, hold an annual or other meeting of certificate holders during 2015 at which Trustees were elected, the Trust was not required to conduct an advisory vote of certificate holders to approve the compensation of its Named Executive Officers.

Summary Compensation Table

The following table sets forth information concerning compensation for services in all capacities awarded to, earned by, or paid to, the Trust’s Chief Executive Officer and its Chief Financial Officer, who are its only executive officers (collectively, the “Named Executive Officers”):

|

Name and Position |

Year |

Salary ($) |

Bonus ($) |

Change in Actuarial Present Value of Accumulated Benefits ($)(1) |

All Other Compensation ($)(2)(3) |

Total |

|||||||||||||||

|

David M. Peterson |

2015 |

$ | 254,167 | $ | 50,000 | $ | 34,782 | $ | 15,250 | $ | 354,199 | ||||||||||

|

General Agent, |

2014 |

$ | 208,750 | $ | 40,000 | $ | 152,379 | $ | 12,525 | $ | 413,654 | ||||||||||

|

Chief Executive Officer and Secretary (through November 4, 2016) |

2013 |

$ | 172,917 | $ | 38,000 | $ | 0 | $ | 10,375 | $ | 221,292 | ||||||||||

|

Tyler Glover |

2015 |

$ | 112,083 | $ | 30,000 | $ | 3,246 | $ | 6,725 | $ | 152,054 | ||||||||||

|

Co-General Agent, |

2014 |

$ | 93,958 | $ | 20,000 | $ | 6,817 | $ | 5,637 | $ | 126,412 | ||||||||||

|

Chief Executive Officer and Secretary (as of November 5, 2016) |

2013 |

$ | 83,333 | $ | 12,500 | $ | 2,340 | $ | 5,000 | $ | 103,173 | ||||||||||

|

Robert J. Packer |

2015 |

$ | 127,083 | $ | 30,000 | $ | 7,992 | $ | 7,625 | $ | 172,700 | ||||||||||

|

Co-General Agent and |

2014 |

$ | 106,667 | $ | 20,000 | $ | 14,600 | $ | 6,400 | $ | 147,667 | ||||||||||

|

Chief Financial Officer (as of November 5, 2016) |

2013 |

$ | 95,833 | $ | 12,500 | $ | 5,257 | $ | 5,750 | $ | 119,340 | ||||||||||

________________________

(1) Represents the aggregate change in the actuarial present value of the Named Executive Officer’s accumulated benefit under all defined benefit and actuarial pension plans (including supplemental plans) from the pension plan measurement date used for financial statement reporting purposes with respect to the Trust’s audited financial statements for the prior completed fiscal year to the pension plan measurement date used for financial statement reporting purposes with respect to the Trust’s audited financial statements for the covered fiscal year. For Mr. Peterson, the actual change for 2013 is ($7,987). Overall, the increase for 2014 is larger than previous years due to an update in the mortality assumptions and decrease in the discount rate used to calculate the value of the benefits.

(2) Represents contributions by the Trust to the account of the Named Executive Officer under the Trust’s defined contribution retirement plan.

(3) The aggregate value of the perquisites and other personal benefits, if any, received by the Named Executive Officer for all years presented have not been reflected in the table because the amount was below the Securities and Exchange Commission’s $10,000 threshold for disclosure.

Employment Agreements

The Trust is not a party to any employment agreements with any of its Named Executive Officers. There is no compensation plan or arrangement with respect to any individual named in the Summary Compensation Table that results, or will result, from the resignation, retirement or any other termination of such individual’s employment or from a change in control of Texas Pacific or from a change in the individual’s responsibilities following a change in control of Texas Pacific.

Pension Benefits

|

Name |

Plan Name |

|

Number of Years Credited Service |

|

Actuarial Accumulated Benefit ($) |

|

Payments during Last Fiscal Year |

| |||

|

David M. Peterson |

Restated Texas Pacific Land Trust Revised Employees’ Pension Plan |

|

20.5 |

|

$ |

400,807 |

|

$ |

0 |

| |

|

Tyler Glover |

Restated Texas Pacific Land Trust Revised Employees’ Pension Plan |

3.0 |

$ |

12,403 |

$ |

0 |

|||||

|

|

|

|

|

|

|

|

|

|

|

| |

|

Robert J. Packer |

Restated Texas Pacific Land Trust Revised Employees’ Pension Plan |

|

3.5 |

|

$ |

31,187 |

|

$ |

0 |

| |

The Restated Texas Pacific Land Trust Revised Employees’ Pension Plan is a noncontributory defined benefit pension plan qualified under Section 401 of the Internal Revenue Code in which the employees, excluding the Trustees, participate. The remuneration covered by the Plan is Salary. The Plan provides a normal retirement benefit equal to 1.5% of a participant’s average Salary for the last five years prior to retirement for each year of Credited Service under the Plan. Credited Service is earned from the participant’s date of membership in the Plan, which is generally not the participant’s date of hire by the Trust. For information concerning the valuation method and material assumptions used in quantifying the present value of the Named Executive Officers’ current accrued benefits, see Note 5 of the Notes to Financial Statements contained in our Annual Report on Form 10-K.

As of December 31, 2015, the annual accrued normal retirement benefits are estimated to be $58,425, $4,074 and $5,382 for Mr. Peterson, Mr. Glover and Mr. Packer, respectively.

The Plan provides for early retirement after 20 years of service with the Trust. Early retirement benefits are calculated in the same manner as the normal retirement benefit, but are reduced by 1/15 for each of the first five years and 1/30 for each of the next five years that benefits commence prior to normal retirement. If benefits commence more than 10 years prior to normal retirement, the early retirement benefit payable at age 55 is reduced actuarially for the period prior to age 55. The annual early retirement benefit payable to Mr. Peterson as of January 1, 2016 is estimated to be $19,070. Mr. Glover and Mr. Packer are not currently eligible for an early retirement benefit.

Trustee Compensation Table

|

Name |

Fees Earned or Paid in Cash ($) (1) |

Total ($) |

||||||

|

Maurice Meyer III |

$ | 4,000 | $ | 4,000 | ||||

|

John R. Norris III |

$ | 2,000 | $ | 2,000 | ||||

(1) As Chairman, Mr. Meyer receives $4,000 annually for his services as Chairman of the Trustees. Each of the other Trustees receives $2,000 annually for his services as such.

Compensation Committee Interlocks and Insider Participation

Each of the Trustees is a member of the Nominating, Compensation and Governance Committee of the Trustees. None of the Trustees is, or has been in the past, an officer or employee of the Trust. None of the Trustees had any relationship requiring disclosure by the Trust pursuant to Item 404 of Regulation S-K. There are no interlocking relationships requiring disclosure by the Trust pursuant to Item 407(e)(4)(iii) of Regulation S-K.

Compensation Committee Report

The Nominating, Compensation and Governance Committee has reviewed and discussed the Compensation Discussion and Analysis section of this proxy statement and, based on such review and discussion, recommended that it be included in this Report.

Maurice Meyer III

John R. Norris III

REPORT OF THE NOMINATING AND COMPENSATION COMMITTEE

The Nominating and Compensation Committee has the sole authority to determine the compensation of the General Agent and Chief Executive Officer. The Nominating and Compensation Committee reviews and approves annually the goals and objectives relevant to compensation of the General Agent. The compensation of Mr. Peterson reflects the evaluation of the Nominating and Compensation Committee on his performance against the goals and objectives of protecting and maintaining the assets of the Trust. Mr. Peterson’s compensation consists of salary and cash bonus.

The Nominating and Compensation Committee reviews and approves, as appropriate, annually the compensation of the other executive officers and reviews compensation of other employees generally.

The Nominating and Compensation Committee obtains recommendations from the General Agent and reviews and approves, as appropriate, specific annual individual awards for officers and the aggregate amount of annual awards under any applicable arrangements, plans, policies and programs.

Maurice Meyer III

John R. Norris III

REPORT OF THE AUDIT COMMITTEE

The Audit Committee oversees the Company’s financial reporting process on behalf of the Trustees. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed with management the audited financial statements in the Form 10-K, including a discussion of the acceptability of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

The Audit Committee reviewed and discussed with the independent registered public accounting firm, Lane Gorman Trubitt, PLLC (“Lane Gorman Trubitt”), which is responsible for expressing an opinion on the conformity of those audited financial statements with the standards of the Public Company Accounting Oversight Board, the matters required to be discussed by Statements on Auditing Standards (SAS 61), as may be modified or supplemented, and their judgments as to the acceptability of the Trust’s accounting principles and such other matters as are required to be discussed with the Audit Committee under the standards of the Public Company Accounting Oversight Board.

In addition, the Audit Committee has discussed with Lane Gorman Trubitt their independence from management and the Trust, including receiving the written disclosures and letter from Lane Gorman Trubitt as required by the Independence Standards Board Standard No. 1, as may be modified or supplemented, and has considered the compatibility of any non-audit services with the auditors’ independence.

The Audit Committee discussed with Lane Gorman Trubitt the overall scope and plans for their audit. The Audit Committee meets with Lane Gorman Trubitt, with and without management present, to discuss the results of their examinations and the overall quality of the Trust’s financial reporting.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Trustees, and the Trustees approved, that the audited financial statements be included in the Form 10-K for the year ended December 31, 2015 for filing with the SEC.

Maurice Meyer III

INDEPENDENT AUDITOR

The Audit Committee has retained Lane Gorman Trubitt as the Trust’s independent auditor for the current fiscal year. The Audit Committee has established a policy requiring approval by it of all fees for audit and non-audit services to be provided by the Trust’s independent registered public accountants, prior to commencement of such services. Consideration and approval of fees generally occurs at the Audit Committee’s regularly scheduled meetings or, to the extent that such fees may relate to other matters to be considered at special meetings, at those special meetings. All professional services rendered by Lane Gorman Trubitt during 2015 and 2014 were furnished at customary rates. A summary of the fees which Lane Gorman Trubitt billed the Trust for services provided in 2015 and 2014 is set forth below:

Audit Fees. Lane Gorman Trubitt billed the Trust approximately $96,800 in 2015 and $93,500 in 2014 in connection with its audits of the financial statements and internal controls over financial reporting of the Trust in 2015 and 2014.

Audit-Related Fees. Lane Gorman Trubitt did not bill the Trust any amount for audit-related services in either 2015 or 2014 not included in “Audit Fees”, above.

Tax Fees. Lane Gorman Trubitt did not bill the Trust for any tax fees in 2015 or 2014.

All Other Fees. Lane Gorman Trubitt did not bill the Trust any other fees in either 2015 or 2014.

The Audit Committee has established a policy requiring approval by it of all fees for audit and non-audit services to be provided by the Trust’s independent registered public accountants, prior to commencement of such services. Consideration and approval of fees generally occurs at the Audit Committee’s regularly scheduled meetings or, to the extent that such fees may relate to other matters to be considered at special meetings, at those special meetings.

None of the fees described above under the captions “Audit-Related Fees,” “Tax Fees” and “All Other Fees” were approved by the Audit Committee pursuant to the “de minimis” exception set forth in Rule 2-01(c)(7)(i)(C) under SEC Regulation S-X.

A representative of Lane Gorman Trubitt, independent auditor for the Trust for fiscal 2015 and the current fiscal year, will not be present at the Special Meeting, and therefore will not have an opportunity to make a statement, and will not be available to respond to appropriate questions.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The Trust does not maintain any compensation plans (or individual compensation arrangements) under which equity securities of the Trust are authorized for issuance.

Security Ownership of Certain Beneficial Owners

The following table sets forth information as to all persons known to the Trust to be the beneficial owner of more than 5% of the Trust’s voting securities (Certificates of Proprietary Interest and Sub-share Certificates) as of December 6, 2016. The Certificates of Proprietary Interest and Sub-share Certificates are freely interchangeable in the ratio of one Certificate of Proprietary Interest for 3,000 Sub-shares or 3,000 Sub-shares for one Certificate of Proprietary Interest, and are deemed to constitute a single class. As December 6, 2016, 7,929,780 Sub-share Certificates were outstanding.

|

Name and Address |

|

Number of Securities Beneficially Owned |

|

Type of Securities |

|

Percent of Class |

| ||

|

|

|

|

|

|

|

|

| ||

|

Craig D. Hodges (1) 2905 Maple Ave. Dallas, TX 75201 |

|

|

565,323 |

|

Sub-share certificates |

|

|

7.12% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Horizon Kinetics LLC (2) 470 Park Avenue South, 4th Floor South, New York, New York 10016 |

|

|

946,567 |

|

Sub-share certificates |

|

|

11.67% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Kinetics Asset Management, LLC (2) 470 Park Avenue South, 4th Floor South, New York, New York 10016 |

|

|

645,772 |

|

Sub-share certificates |

|

|

7.95% |

|

_______________________

|

(1) |

The information set forth is based on a joint filing on Schedule 13G made on February 12, 2016 by Craig D. Hodges (“Hodges”), Hodges Capital Holdings, Inc. (“Holdings”), First Dallas Securities, Inc. (“Securities”), Hodges Capital Management, Inc. (“HCM”), Hodges Fund (“HF”), Hodges Small Cap Fund (“HSCF”), Hodges Blue Chip 25 Fund (“HBCF”), Hodges Small Intrinsic Value Fund (“HSIVF”) and Hodges Small-Mid Cap Fund (“HSMCF”). According to the filing, (i) Hodges shares voting power with respect to 427,410 of the Sub-share certificates and shares dispositive power with respect to 565,323 of the Sub-share certificates, (ii) Holdings shares voting power with respect to 427,410 of the Sub-share certificates and shares dispositive power with respect to 565,323 of the Sub-share certificates, (iii) Securities shares dispositive power with respect to 52,277 of the Sub-share certificates, (iv) HCM shares voting power with respect to 422,600 of the Sub-share certificates and shares dispositive power with respect to 508,236 of the Sub-share certificates, (v) HF shares voting and dispositive power with respect to 177,300 of the Sub-share certificates, (vi) HSCF shares voting and dispositive power with respect to 235,300 of the Sub-share certificates, (vii) HBCF shares voting and dispositive power with respect to 3,500 of the Sub-share certificates, (viii) HSIVF shares voting and dispositive power with respect to 4,000 of the Sub-share certificates, and (ix) HSMCF shares voting and dispositive power with respect to 2,500 of the Sub-share certificates. The Schedule 13G indicates that (A) Securities is a broker-dealer and an investment adviser, (B) HCM is an investment adviser, (C) HF is a series of an investment company, (D) HSCF is a series of an investment company, (E) HBCF is a series of an investment company, (F) HSIVF is a series of an investment company, (G) HSMCF is a series of an investment company, and (H) Holdings is a holding company. The Schedule 13G further indicates that Hodges is the controlling shareholder of Holdings, that Holdings is the parent holding company of Securities and HCM and that HF, HSCF, HBCF, HSIVF and HSMCF are all series of an investment company as to which HCM serves as the investment adviser. The filing indicates that the Sub-share certificates were not acquired and are not held for the purpose of, or with the effect of, changing or influencing the control of the Trust and are not held in connection with, or as a participant in, any transaction having that purpose or effect.. |

|

(2) |

The information set forth is based on a joint filing on Schedule 13D made on March 8, 2016 by Horizon Kinetics LLC (“Horizon”), Kinetics Asset Management, LLC (“Kinetics”), Horizon Asset Management LLC (“HAM”) and Kinetics Advisers, LLC (“Advisers”). According to the Schedule 13D, Horizon has shared voting power and shared dispositive power with respect to 1,646,801 of the Sub-share certificates, Kinetics has sole voting power and sole dispositive power with respect to 946,567 of the Sub-share certificates, HAM has sole voting power and sole dispositive power with respect to 645,772 of the Sub-share certificates, and Advisers has sole voting power and sole dispositive power with respect to 54,462 of the Sub-share certificates. The filing indicates that Horizon is a holding company and Kinetics, HAM and Advisers are investment advisers and that the Sub-share certificates were not acquired and are not held for the purpose of, or with the effect of, changing or influencing the control of the Trust and were not acquired and are not held in connection with, or as a participant in, any transaction having that purpose or effect. |

Security Ownership of Management

The following table sets forth information as to equity securities (Certificates of Proprietary Interest and Sub-share Certificates) beneficially owned directly or indirectly by all Trustees, nominees for Trustee, and executive officers of the Trust, naming them individually and as a group, as of December 6, 2016. The Certificates of Proprietary Interest and Sub-share Certificates are freely interchangeable in the ratio of one Certificate of Proprietary Interest for 3,000 Sub-shares or 3,000 Sub-shares for one Certificate of Proprietary Interest, and are deemed to constitute a single class. As of December 6, 2016, 7,929,780 Sub-share Certificates were outstanding.

|

Title and Class (1) |

Name of Beneficial Owner |

|

Amount and Nature of Ownership on December 6, 2016 |

|

|

Percent of Class |

| |||

|

|

|

|

|

|

|

|

|

|

| |

|

Sub-share certificates: |

Maurice Meyer III |

|

|

72,425(2) |

|

|

|

* |

| |

|

Sub-share certificates: |

John R. Norris III |

|

|

1,000 |

|

|

|

* |

| |

|

Sub-share certificates: |

David E. Barry |

|

|

-- |

|

|

|

-- |

| |

|

Sub-share certificates: |

Tyler Glover |

-- |

-- |

|||||||

|

Sub-share certificates: |

Robert J. Packer |

|

|

-- |

|

|

|

-- |

| |

|

Sub-share certificates: |

All Trustees, nominees and Officers as a Group |

|

|

73,425 |

|

|

|

* |

||

_______________________

*Indicates ownership of less than 1% of the class.

|

(1) |

The Certificates of Proprietary Interest and Sub-share Certificates are freely interchangeable in the ratio of one Certificate of Proprietary Interest for 3,000 Sub-shares or 3,000 Sub-shares for one Certificate of Proprietary Interest, and are deemed to constitute a single class. The figures set forth in the table represent Sub-share certificates. On December 6, 2016, no Trustee or executive officer was the beneficial owner, directly or indirectly, of any Certificates of Proprietary Interest. |

|

(2) |

Does not include 11,500 Sub-shares owned by the wife of Mr. Meyer with respect to which Mr. Meyer disclaims any beneficial ownership. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

There are no reportable transactions or proposed transactions between the Trust and any Trustee or executive officer of the Trust or any security holder of the Trust or any member of the immediate family of any of the foregoing persons. Transactions with Trustees, executive officers or five percent or greater stockholders, or immediate family members of the foregoing, which might require disclosure, would be subject to review, approval or ratification by the Nominating and Compensation Committee of the Trustees, which is composed of all of the Trustees. The Nominating and Compensation Committee’s charter empowers it to review any transactions, including loans, which may confer any benefit upon any Trustee, executive officer or affiliated entity to confirm compliance with the Trust’s Code of Conduct and Ethics and applicable law. The Nominating and Compensation Committee has not adopted specific standards for evaluating such transactions beyond that mentioned above, because it is the sense of the Trustees that the activities and procedures of the Nominating and Compensation Committee should remain flexible so that it may appropriately respond to changing circumstances.

VOTING PROCEDURES

Tabulation of Votes

The voting of proxies will be tabulated by a representative of American Stock Transfer & Trust Co., which has been appointed as the Company’s independent inspector of election. The inspector of election will be present at the meeting in order to tabulate the voting of any proxies returned and ballots cast at that time.

Effect of Abstention and Broker Non-Votes

Abstentions and broker non-votes are each included in the determination of the number of shares present and voting for the purpose of determining whether a quorum is present, and each is tabulated separately. In determining whether a proposal has been approved, abstentions are counted in tabulations of the vote cast on proposals presented to shareholders and have the effect of a vote “against” the proposals.

OTHER MATTERS

The Trustees do not intend to bring before the meeting any matter other than the election of a successor Trustee, and they have no present knowledge that any other matters will or may be brought before the meeting by others. However, if any other matters properly come before the meeting, the Trustees and the persons named in the attached proxy intend that such persons shall vote the proxy in accordance with their judgment upon such matters.

|

|

By Order of the Trustees, Tyler Glover, Secretary |

December 7, 2016

Dallas, Texas

|

|

|

|