Investor Presentation June 2021

| 2NYSE: TPL This presentation has been designed to provide general information about Texas Pacific Land Corporation and its subsidiaries (“TPL” or the “Company”). Any information contained or referenced herein is suitable only as an introduction to the Company. The recipient is strongly encouraged to refer to and supplement this presentation with information the Company has filed with the Securities and Exchange Commission (“SEC”). The Company makes no representation or warranty, express or implied, as to the accuracy or completeness of the information contained in this presentation, and nothing contained herein is, or shall be, relied upon as a promise or representation, whether as to the past or to the future. This presentation does not purport to include all of the information that may be required to evaluate the subject matter herein and any recipient hereof should conduct its own independent analysis of the Company and the data contained or referred to herein. Unless otherwise stated, statements in this presentation are made as of the date of this presentation, and nothing shall create an implication that the information contained herein is correct as of any time after such date. TPL reserves the right to change any of its opinions expressed herein at any time as it deems appropriate. The Company disclaims any obligations to update the data, information or opinions contained herein or to notify the market or any other party of any such changes, other than required by law. Industry and Market Data The Company has neither sought nor obtained consent from any third party for the use of previously published information. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein. The Company shall not be responsible or have any liability for any misinformation contained in any third party report, SEC or other regulatory filing. The industry in which the Company operates is subject to a high degree of uncertainty and risk due to a variety of factors, which could cause our results to differ materially from those expressed in these third-party publications. Some of the data included in this presentation is based on TPL’s good faith estimates, which are derived from TPL’s review of internal sources as well as the third party sources described above. All registered or unregistered service marks, trademarks and trade names referred to in this presentation are the property of their respective owners, and TPL’s use herein does not imply an affiliation with, or endorsement by, the owners of these service marks, trademarks and trade names. Forward-looking Statements This presentation contains certain forward-looking statements within the meaning of the U.S. federal securities laws that are based on TPL’s beliefs, as well as assumptions made by, and information currently available to, TPL, and therefore involve risks and uncertainties that are difficult to predict. These statements include, but are not limited to, statements about strategies, plans, objectives, expectations, intentions, expenditures and assumptions and other statements that are not historical facts. When used in this document, words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and “project” and similar expressions are intended to identify forward-looking statements. You should not place undue reliance on these forward-looking statements. Although we believe our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this presentation are reasonable, we may be unable to achieve these plans, intentions or expectations and actual results, performance or achievements may vary materially and adversely from those envisaged in this document. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see TPL’s annual report on Form 10-K and quarterly reports on Form 10-Q filed with the SEC. The tables, graphs, charts and other analyses provided throughout this document are provided for illustrative purposes only and there is no guarantee that the trends, outcomes or market conditions depicted on them will continue in the future. There is no assurance or guarantee with respect to the prices at which the Company’s common stock will trade, and such securities may not trade at prices that may be implied herein. TPL’s forecasts and expectations for future periods are dependent upon many assumptions, including the drilling and development plans of our customers, estimates of production and potential drilling locations, which may be affected by commodity price declines, the severity and duration of the COVID-19 pandemic and related economic repercussions or other factors that are beyond TPL’s control. These materials are provided merely for general informational purposes and are not intended to be, nor should they be construed as 1) investment, financial, tax or legal advice, 2) a recommendation to buy or sell any security, or 3) an offer or solicitation to subscribe for or purchase any security. These materials do not consider the investment objective, financial situation, suitability or the particular need or circumstances of any specific individual who may receive or review this presentation, and may not be taken as advice on the merits of any investment decision. Although TPL believes the information herein to be reliable, the Company and persons acting on its behalf make no representation or warranty, express or implied, as to the accuracy or completeness of those statements or any other written or oral communication it makes, safe as provided for by law, and the Company expressly disclaims any liability relating to those statements or communications (or any inaccuracies or omissions therein). These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf. Non-GAAP Financial Measures In this presentation, TPL utilizes earnings before interest, taxes, depreciation and amortization (“EBITDA”), which is not defined in the U.S. generally accepted accounting principles (“GAAP”). TPL believes that EBITDA is a useful supplement to net income as an indicator of operating performance. EBITDA is not presented as an alternative to net income and it should not be considered in isolation or as a substitute for net income. Please see Appendix for a reconciliation of EBITDA to net income, the most directly comparable financial measure calculated in accordance with GAAP. Disclaimer

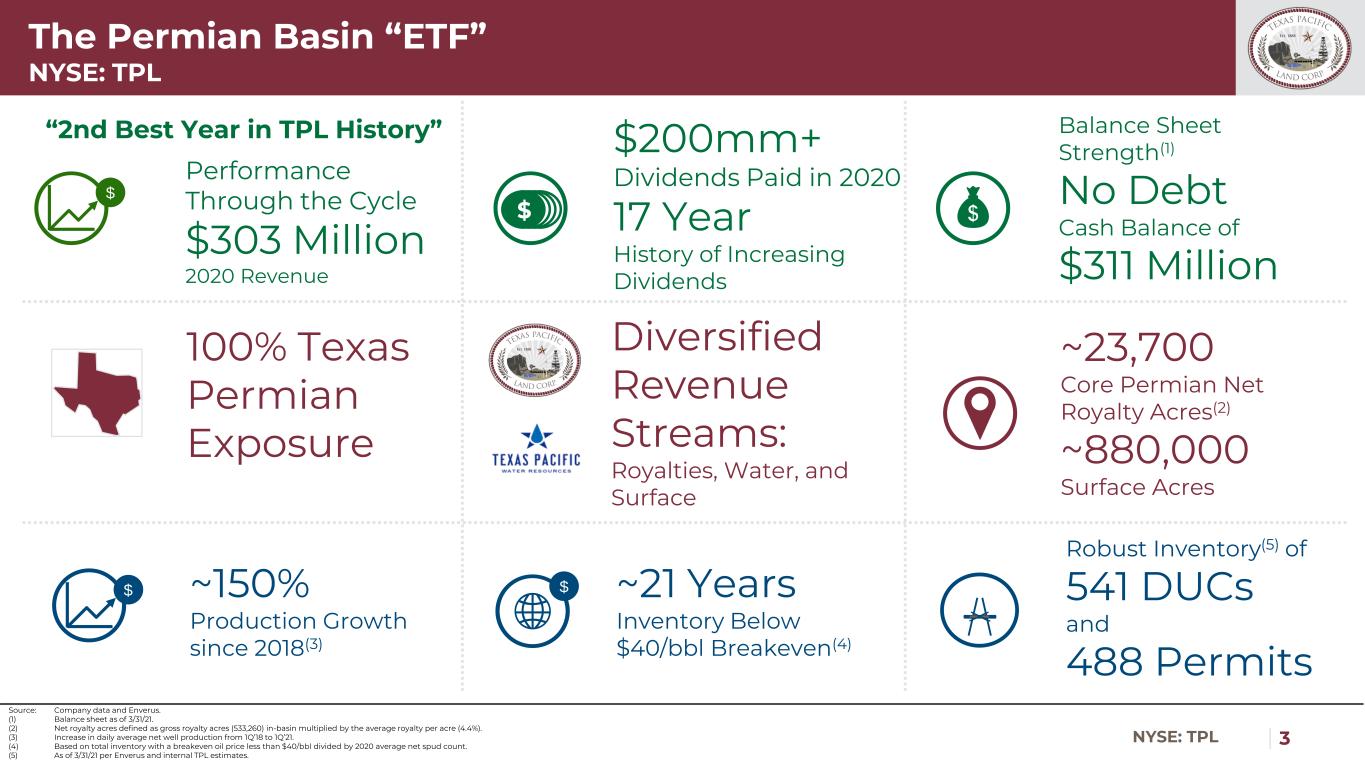

| 3NYSE: TPL The Permian Basin “ETF” NYSE: TPL $ $ $ ~21 Years Inventory Below $40/bbl Breakeven(4) Performance Through the Cycle $303 Million 2020 Revenue ~150% Production Growth since 2018(3) Balance Sheet Strength(1) No Debt Cash Balance of $311 Million $200mm+ Dividends Paid in 2020 17 Year History of Increasing Dividends ~23,700 Core Permian Net Royalty Acres(2) ~880,000 Surface Acres Diversified Revenue Streams: Royalties, Water, and Surface 100% Texas Permian Exposure Source: Company data and Enverus. (1) Balance sheet as of 3/31/21. (2) Net royalty acres defined as gross royalty acres (533,260) in-basin multiplied by the average royalty per acre (4.4%). (3) Increase in daily average net well production from 1Q’18 to 1Q’21. (4) Based on total inventory with a breakeven oil price less than $40/bbl divided by 2020 average net spud count. (5) As of 3/31/21 per Enverus and internal TPL estimates. Robust Inventory(5) of 541 DUCs and 488 Permits “2nd Best Year in TPL History” $

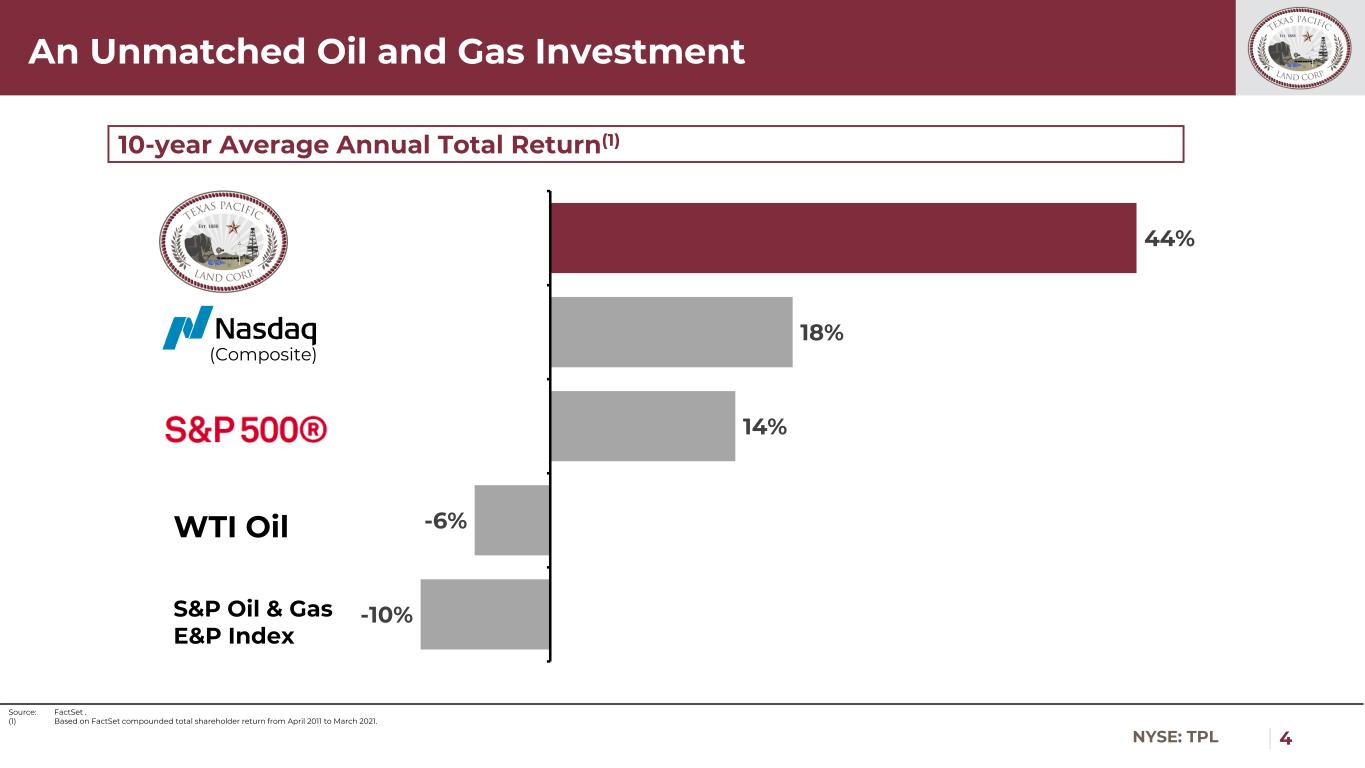

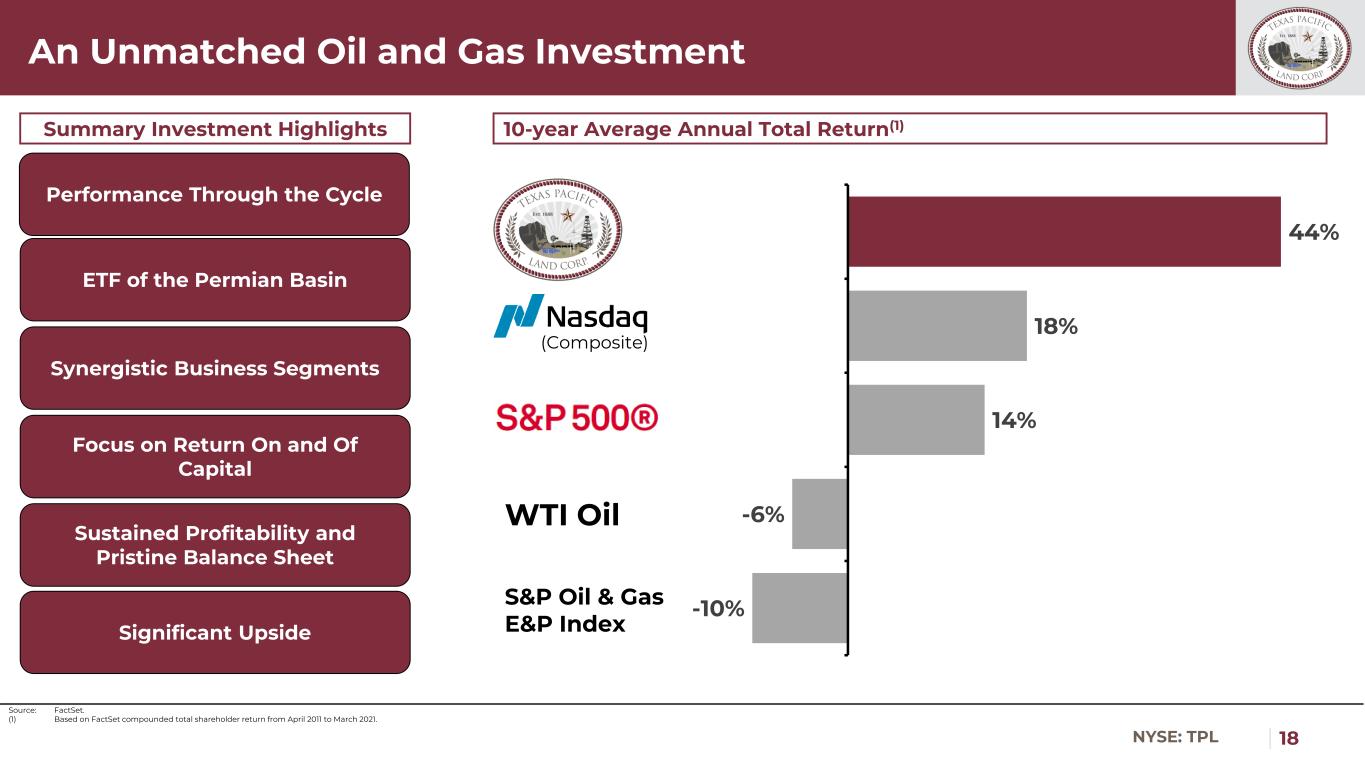

| 4NYSE: TPL An Unmatched Oil and Gas Investment Source: FactSet . (1) Based on FactSet compounded total shareholder return from April 2011 to March 2021. (Composite) WTI Oil S&P Oil & Gas E&P Index 10-year Average Annual Total Return(1) -10% -6% 14% 18% 44%

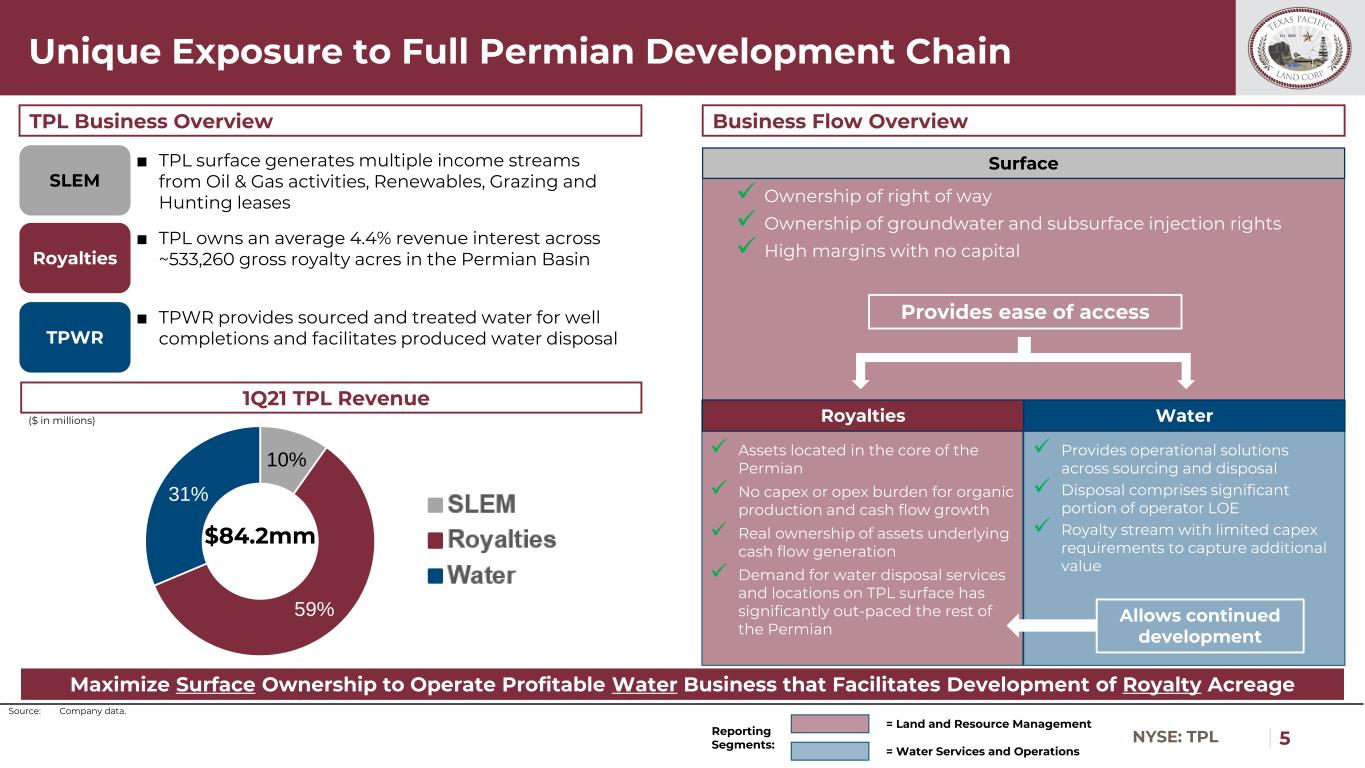

| 5NYSE: TPL Unique Exposure to Full Permian Development Chain ✓ Ownership of right of way ✓ Ownership of groundwater and subsurface injection rights ✓ High margins with no capital Surface Provides ease of access TPL Business Overview Business Flow Overview Maximize Surface Ownership to Operate Profitable Water Business that Facilitates Development of Royalty Acreage Royalties ✓ Assets located in the core of the Permian ✓ No capex or opex burden for organic production and cash flow growth ✓ Real ownership of assets underlying cash flow generation ✓ Demand for water disposal services and locations on TPL surface has significantly out-paced the rest of the Permian Water ✓ Provides operational solutions across sourcing and disposal ✓ Disposal comprises significant portion of operator LOE ✓ Royalty stream with limited capex requirements to capture additional value = Land and Resource Management = Water Services and Operations Reporting Segments: Royalties ■ TPL owns an average 4.4% revenue interest across ~533,260 gross royalty acres in the Permian Basin SLEM ■ TPL surface generates multiple income streams from Oil & Gas activities, Renewables, Grazing and Hunting leases TPWR ■ TPWR provides sourced and treated water for well completions and facilitates produced water disposal 1Q21 TPL Revenue ($ in millions) $84.2mm Allows continued development Source: Company data. 10% 59% 31%

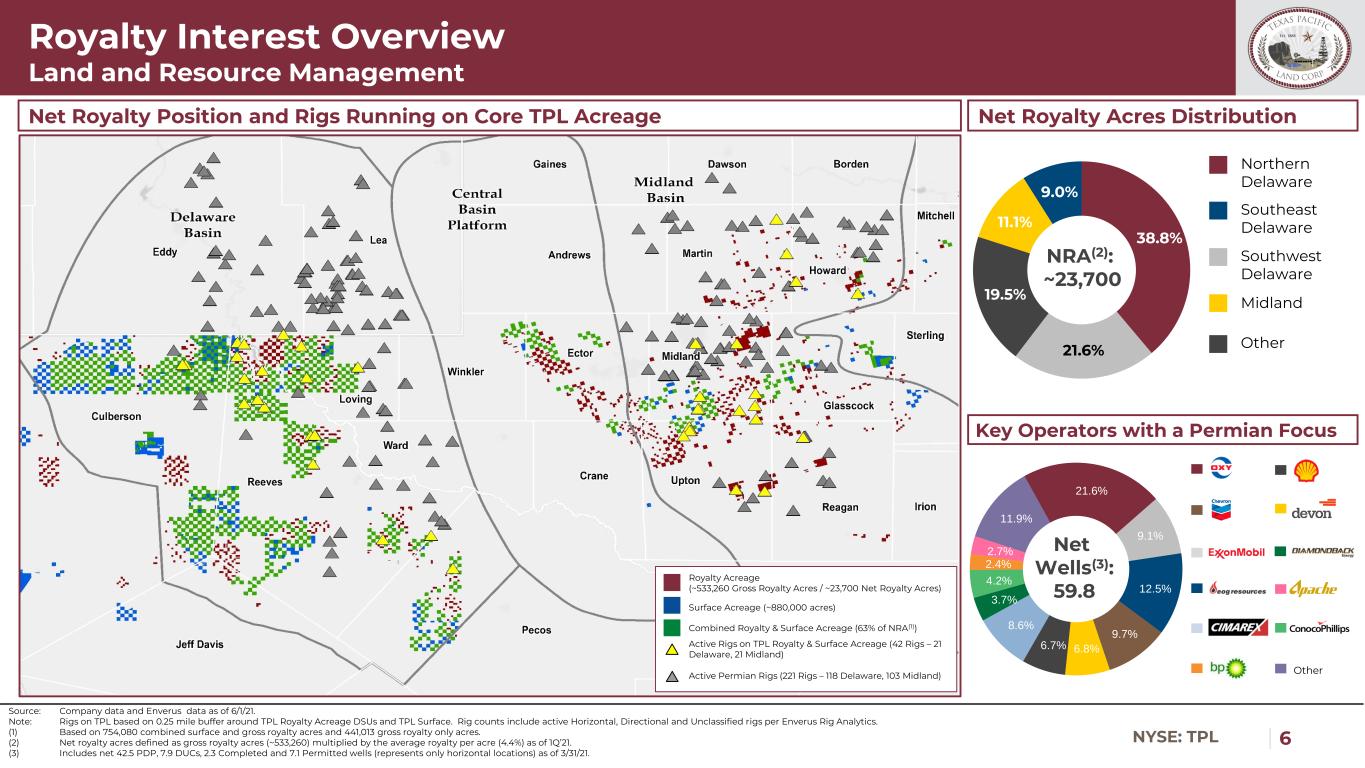

| 6NYSE: TPL 11.9% 21.6% 9.1% 12.5% 9.7% 6.8% 6.7% 8.6% 3.7% 4.2% 2.4% 2.7% 38.8% 21.6% 19.5% 11.1% 9.0% Net Wells(3): 59.8 Royalty Interest Overview Land and Resource Management Net Royalty Position and Rigs Running on Core TPL Acreage Source: Company data and Enverus data as of 6/1/21. Note: Rigs on TPL based on 0.25 mile buffer around TPL Royalty Acreage DSUs and TPL Surface. Rig counts include active Horizontal, Directional and Unclassified rigs per Enverus Rig Analytics. (1) Based on 754,080 combined surface and gross royalty acres and 441,013 gross royalty only acres. (2) Net royalty acres defined as gross royalty acres (~533,260) multiplied by the average royalty per acre (4.4%) as of 1Q’21. (3) Includes net 42.5 PDP, 7.9 DUCs, 2.3 Completed and 7.1 Permitted wells (represents only horizontal locations) as of 3/31/21. NRA(2): ~23,700 Net Royalty Acres Distribution Key Operators with a Permian Focus Other Northern Delaware Southeast Delaware Southwest Delaware Midland Other Royalty Acreage (~533,260 Gross Royalty Acres / ~23,700 Net Royalty Acres) Combined Royalty & Surface Acreage (63% of NRA(1)) Active Rigs on TPL Royalty & Surface Acreage (42 Rigs – 21 Delaware, 21 Midland) Active Permian Rigs (221 Rigs – 118 Delaware, 103 Midland) Surface Acreage (~880,000 acres)

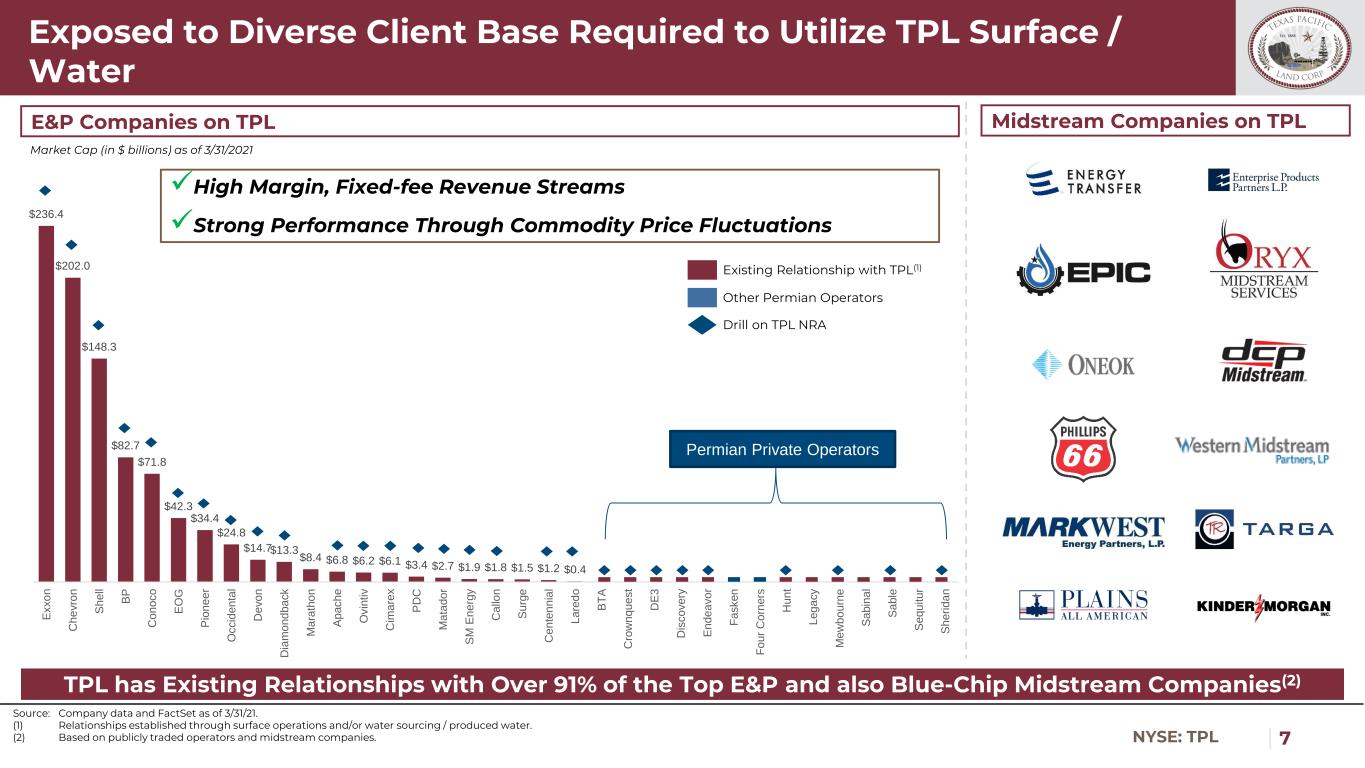

| 7NYSE: TPL $236.4 $202.0 $148.3 $82.7 $71.8 $42.3 $34.4 $24.8 $14.7 $13.3 $8.4 $6.8 $6.2 $6.1 $3.4 $2.7 $1.9 $1.8 $1.5 $1.2 $0.4 E x x o n C h e v ro n S h e ll B P C o n o c o E O G P io n e e r O c c id e n ta l D e v o n D ia m o n d b a c k M a ra th o n A p a c h e O v in ti v C im a re x P D C M a ta d o r S M E n e rg y C a ll o n S u rg e C e n te n n ia l L a re d o B T A C ro w n q u e s t D E 3 D is c o v e ry E n d e a v o r F a s k e n F o u r C o rn e rs H u n t L e g a c y M e w b o u rn e S a b in a l S a b le S e q u it u r S h e ri d a n Exposed to Diverse Client Base Required to Utilize TPL Surface / Water Source: Company data and FactSet as of 3/31/21. (1) Relationships established through surface operations and/or water sourcing / produced water. (2) Based on publicly traded operators and midstream companies. Existing Relationship with TPL(1) Other Permian Operators Drill on TPL NRA TPL has Existing Relationships with Over 91% of the Top E&P and also Blue-Chip Midstream Companies(2) ✓High Margin, Fixed-fee Revenue Streams ✓Strong Performance Through Commodity Price Fluctuations E&P Companies on TPL Midstream Companies on TPL Market Cap (in $ billions) as of 3/31/2021 Permian Private Operators

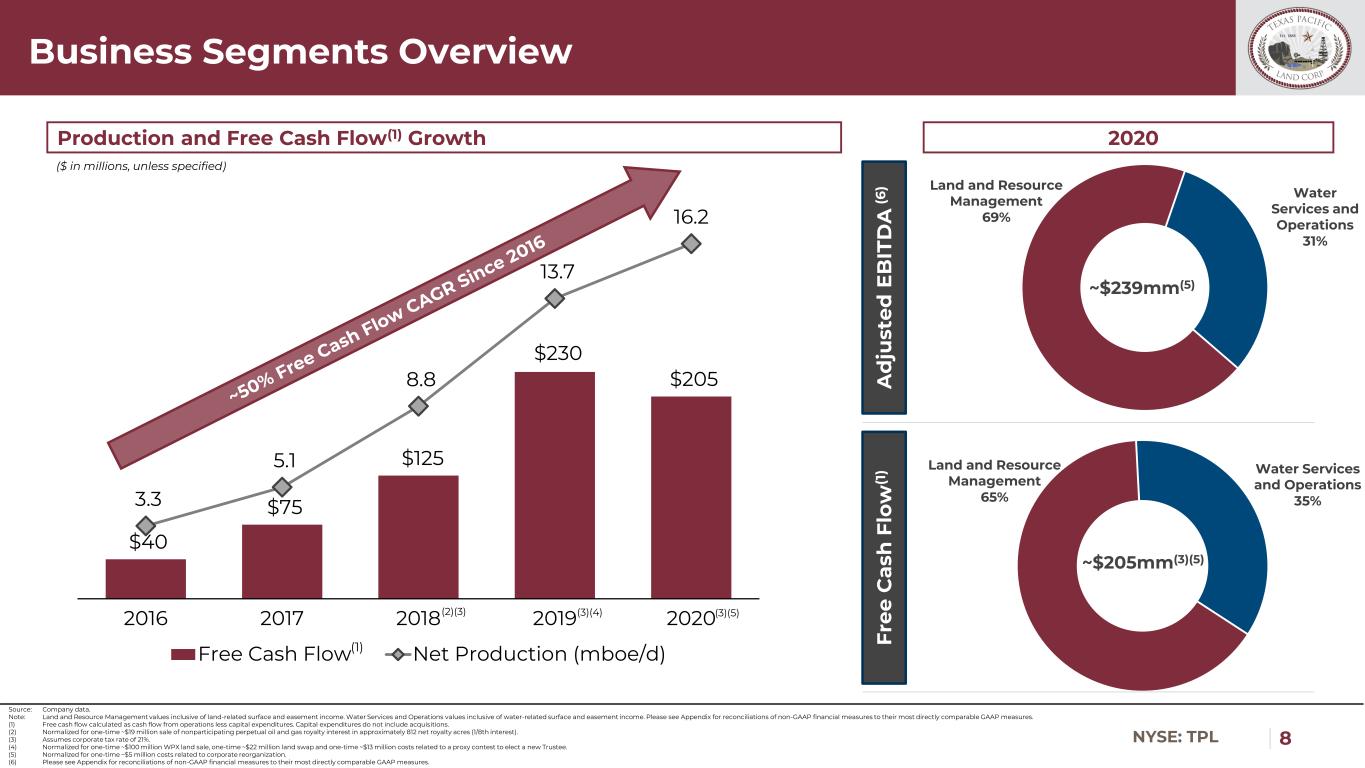

| 8NYSE: TPL $40 $75 $125 $230 $205 3.3 5.1 8.8 13.7 16.2 – 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 18.0 $0 $50 $100 $150 $200 $250 $300 $350 $400 2016 2017 2018 2019 2020 Free Cash Flow Net Production (mboe/d) Land and Resource Management 65% Water Services and Operations 35% Land and Resource Management 69% Water Services and Operations 31% Source: Company data. Note: Land and Resource Management values inclusive of land-related surface and easement income. Water Services and Operations values inclusive of water-related surface and easement income. Please see Appendix for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures. (1) Free cash flow calculated as cash flow from operations less capital expenditures. Capital expenditures do not include acquisitions. (2) Normalized for one-time ~$19 million sale of nonparticipating perpetual oil and gas royalty interest in approximately 812 net royalty acres (1/8th interest). (3) Assumes corporate tax rate of 21%. (4) Normalized for one-time ~$100 million WPX land sale, one-time ~$22 million land swap and one-time ~$13 million costs related to a proxy contest to elect a new Trustee. (5) Normalized for one-time ~$5 million costs related to corporate reorganization. (6) Please see Appendix for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures. Business Segments Overview A d ju st e d E B IT D A (6 ) 2020 ~$205mm(3)(5) F re e C a sh F lo w (1 ) ~$239mm(5) Production and Free Cash Flow(1) Growth (3)(4) ($ in millions, unless specified) (2)(3) (1) (3)(5)

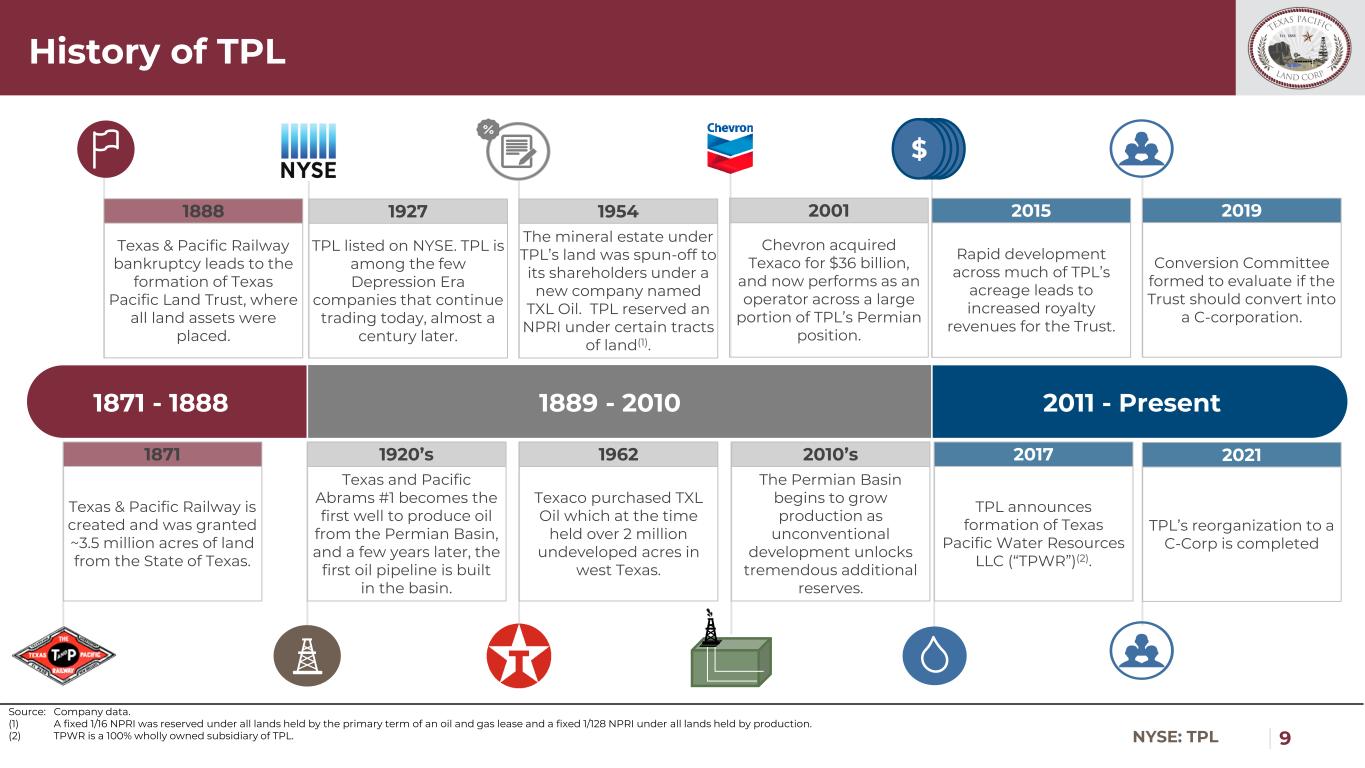

| 9NYSE: TPL History of TPL Source: Company data. (1) A fixed 1/16 NPRI was reserved under all lands held by the primary term of an oil and gas lease and a fixed 1/128 NPRI under all lands held by production. (2) TPWR is a 100% wholly owned subsidiary of TPL. 1871 - 1888 1889 - 2010 2011 - Present Texas & Pacific Railway bankruptcy leads to the formation of Texas Pacific Land Trust, where all land assets were placed. 1888 Texas and Pacific Abrams #1 becomes the first well to produce oil from the Permian Basin, and a few years later, the first oil pipeline is built in the basin. 1920’s The mineral estate under TPL’s land was spun-off to its shareholders under a new company named TXL Oil. TPL reserved an NPRI under certain tracts of land(1). 1954 Texaco purchased TXL Oil which at the time held over 2 million undeveloped acres in west Texas. 1962 Rapid development across much of TPL’s acreage leads to increased royalty revenues for the Trust. 2015 Chevron acquired Texaco for $36 billion, and now performs as an operator across a large portion of TPL’s Permian position. 2001 Conversion Committee formed to evaluate if the Trust should convert into a C-corporation. 2019 Texas & Pacific Railway is created and was granted ~3.5 million acres of land from the State of Texas. 1871 The Permian Basin begins to grow production as unconventional development unlocks tremendous additional reserves. 2010’s TPL announces formation of Texas Pacific Water Resources LLC (“TPWR”)(2). 2017 TPL listed on NYSE. TPL is among the few Depression Era companies that continue trading today, almost a century later. 1927 $ TPL’s reorganization to a C-Corp is completed 2021

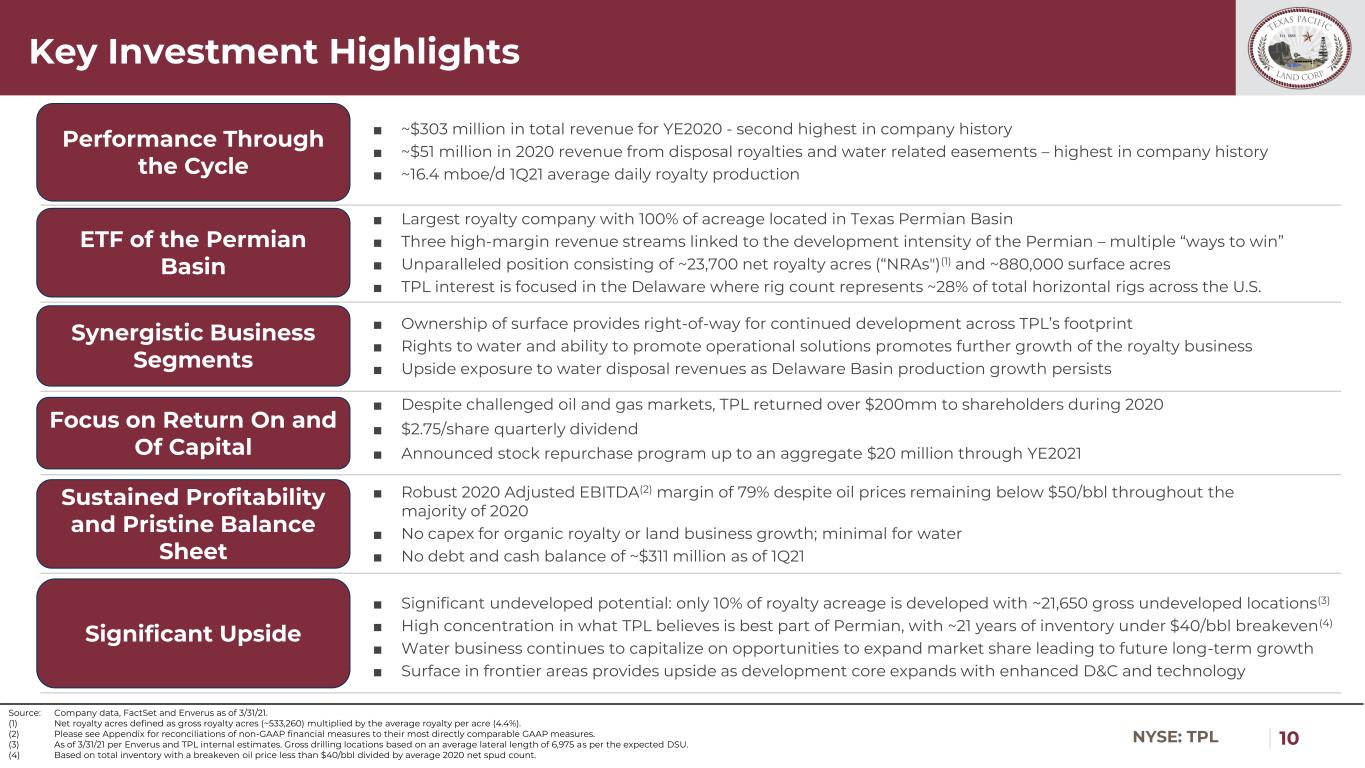

| 10NYSE: TPL Key Investment Highlights Sustained Profitability and Pristine Balance Sheet Focus on Return On and Of Capital ETF of the Permian Basin Performance Through the Cycle ■ Largest royalty company with 100% of acreage located in Texas Permian Basin ■ Three high-margin revenue streams linked to the development intensity of the Permian – multiple “ways to win” ■ Unparalleled position consisting of ~23,700 net royalty acres (“NRAs")(1) and ~880,000 surface acres ■ TPL interest is focused in the Delaware where rig count represents ~28% of total horizontal rigs across the U.S. ■ Despite challenged oil and gas markets, TPL returned over $200mm to shareholders during 2020 ■ $2.75/share quarterly dividend ■ Announced stock repurchase program up to an aggregate $20 million through YE2021 ■ Robust 2020 Adjusted EBITDA(2) margin of 79% despite oil prices remaining below $50/bbl throughout the majority of 2020 ■ No capex for organic royalty or land business growth; minimal for water ■ No debt and cash balance of ~$311 million as of 1Q21 ■ Significant undeveloped potential: only 10% of royalty acreage is developed with ~21,650 gross undeveloped locations(3) ■ High concentration in what TPL believes is best part of Permian, with ~21 years of inventory under $40/bbl breakeven(4) ■ Water business continues to capitalize on opportunities to expand market share leading to future long-term growth ■ Surface in frontier areas provides upside as development core expands with enhanced D&C and technology Source: Company data, FactSet and Enverus as of 3/31/21. (1) Net royalty acres defined as gross royalty acres (~533,260) multiplied by the average royalty per acre (4.4%). (2) Please see Appendix for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures. (3) As of 3/31/21 per Enverus and TPL internal estimates. Gross drilling locations based on an average lateral length of 6,975 as per the expected DSU. (4) Based on total inventory with a breakeven oil price less than $40/bbl divided by average 2020 net spud count. Synergistic Business Segments ■ Ownership of surface provides right-of-way for continued development across TPL’s footprint ■ Rights to water and ability to promote operational solutions promotes further growth of the royalty business ■ Upside exposure to water disposal revenues as Delaware Basin production growth persists Significant Upside ■ ~$303 million in total revenue for YE2020 - second highest in company history ■ ~$51 million in 2020 revenue from disposal royalties and water related easements – highest in company history ■ ~16.4 mboe/d 1Q21 average daily royalty production

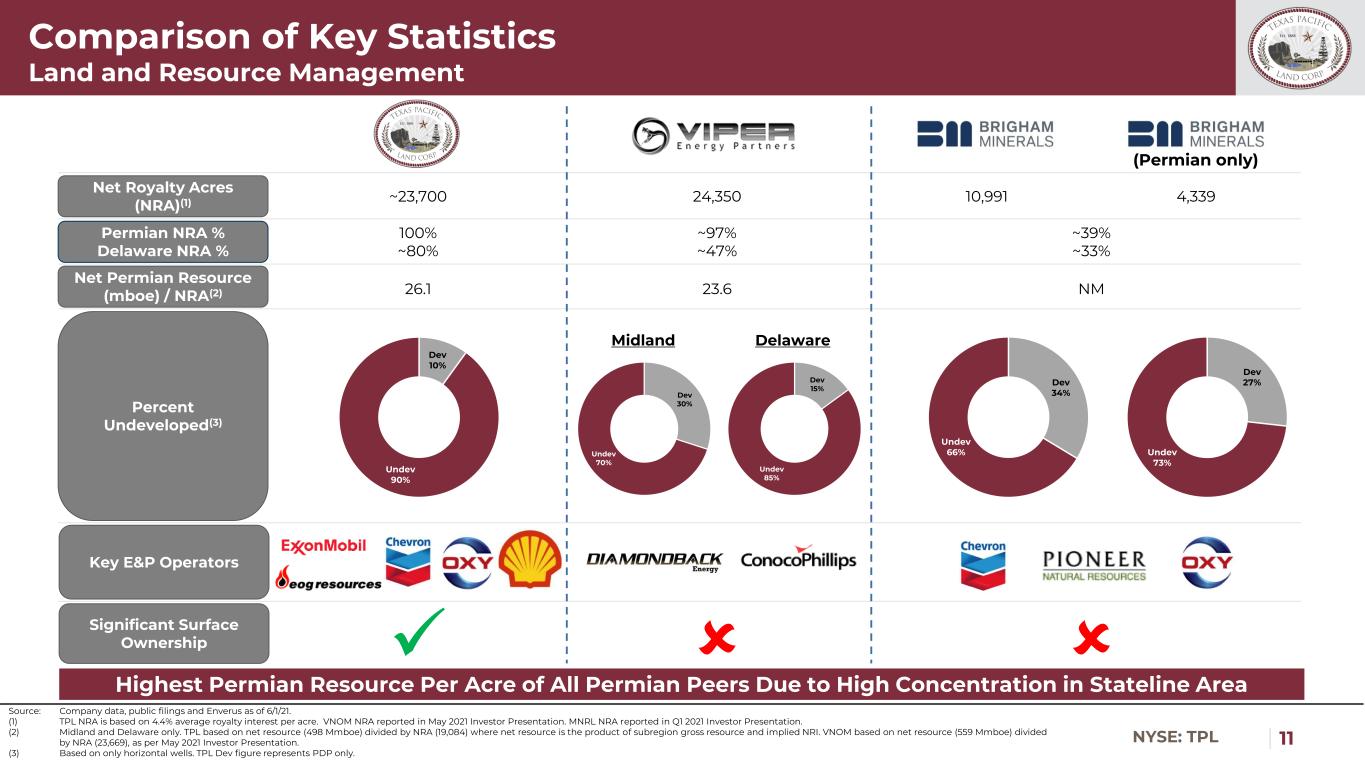

| 11NYSE: TPL Comparison of Key Statistics Land and Resource Management Source: Company data, public filings and Enverus as of 6/1/21. (1) TPL NRA is based on 4.4% average royalty interest per acre. VNOM NRA reported in May 2021 Investor Presentation. MNRL NRA reported in Q1 2021 Investor Presentation. (2) Midland and Delaware only. TPL based on net resource (498 Mmboe) divided by NRA (19,084) where net resource is the product of subregion gross resource and implied NRI. VNOM based on net resource (559 Mmboe) divided by NRA (23,669), as per May 2021 Investor Presentation. (3) Based on only horizontal wells. TPL Dev figure represents PDP only. Net Royalty Acres (NRA)(1) Permian NRA % Delaware NRA % 10,991~23,700 100% ~80% Percent Undeveloped(3) ~39% ~33% 4,339 Highest Permian Resource Per Acre of All Permian Peers Due to High Concentration in Stateline Area 24,350 ~97% ~47% Net Permian Resource (mboe) / NRA(2) 26.1 23.6 NM Key E&P Operators Significant Surface Ownership ✓ (Permian only) Midland Delaware Dev 34% Undev 66% Dev 27% Undev 73% Dev 10% Undev 90% Dev 30% Undev 70% Dev 15% Undev 85%

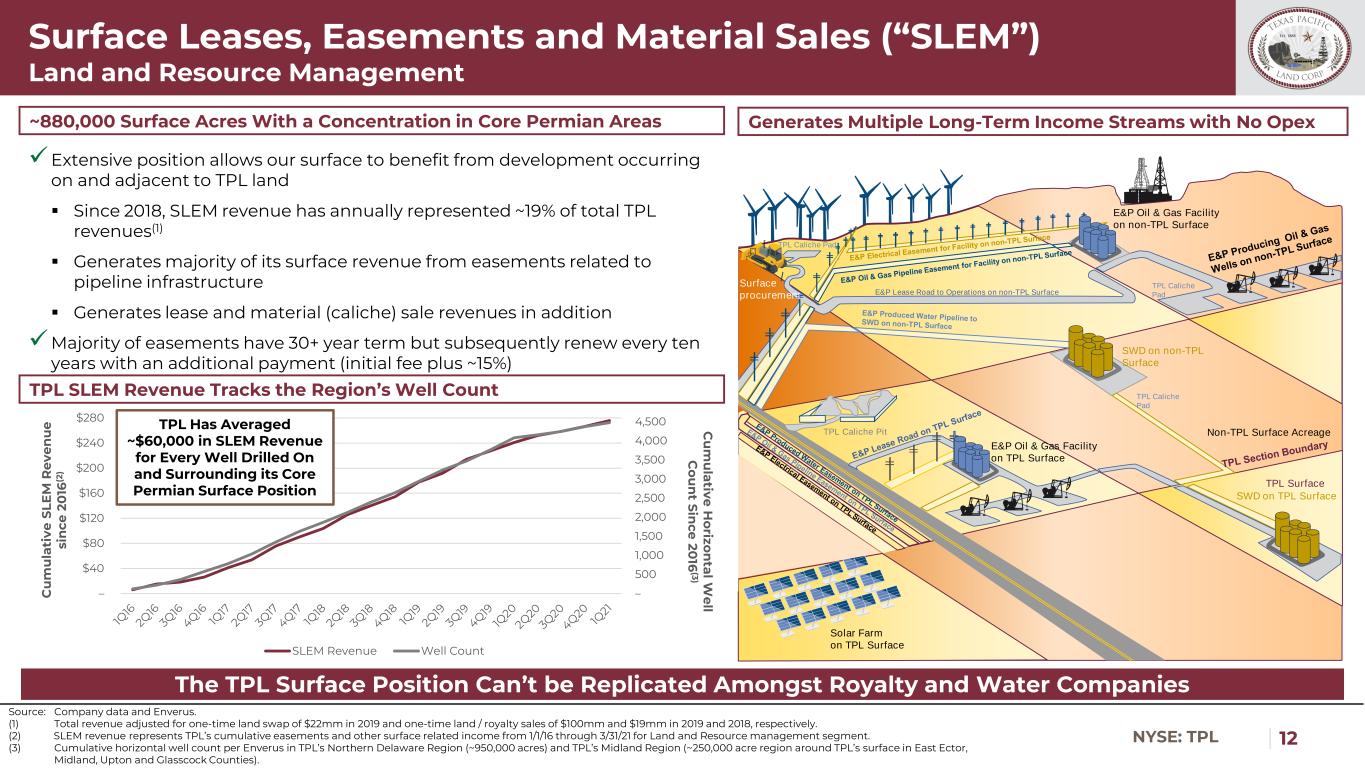

| 12NYSE: TPL – 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 – $40 $80 $120 $160 $200 $240 $280 C u m u la tiv e H o rizo n ta l W e ll C o u n t S in c e 2 0 16 (3 ) C u m u la ti v e S L E M R e v e n u e si n c e 2 0 16 (2 ) SLEM Revenue Well Count ✓Extensive position allows our surface to benefit from development occurring on and adjacent to TPL land ▪ Since 2018, SLEM revenue has annually represented ~19% of total TPL revenues(1) ▪ Generates majority of its surface revenue from easements related to pipeline infrastructure ▪ Generates lease and material (caliche) sale revenues in addition ✓Majority of easements have 30+ year term but subsequently renew every ten years with an additional payment (initial fee plus ~15%) Surface Leases, Easements and Material Sales (“SLEM”) Land and Resource Management Generates Multiple Long-Term Income Streams with No Opex TPL Has Averaged ~$60,000 in SLEM Revenue for Every Well Drilled On and Surrounding its Core Permian Surface Position The TPL Surface Position Can’t be Replicated Amongst Royalty and Water Companies ~880,000 Surface Acres With a Concentration in Core Permian Areas Surface procurement TPL Caliche Pad E&P Lease Road to Operations on non-TPL Surface TPL Caliche Pit E&P Oil & Gas Facility on TPL Surface Solar Farm on TPL Surface TPL Caliche Pad TPL Caliche Pad SWD on non-TPL Surface Non-TPL Surface Acreage TPL Surface SWD on TPL Surface E&P Oil & Gas Facility on non-TPL Surface TPL SLEM Revenue Tracks the Region’s Well Count Source: Company data and Enverus. (1) Total revenue adjusted for one-time land swap of $22mm in 2019 and one-time land / royalty sales of $100mm and $19mm in 2019 and 2018, respectively. (2) SLEM revenue represents TPL’s cumulative easements and other surface related income from 1/1/16 through 3/31/21 for Land and Resource management segment. (3) Cumulative horizontal well count per Enverus in TPL’s Northern Delaware Region (~950,000 acres) and TPL’s Midland Region (~250,000 acre region around TPL’s surface in East Ector, Midland, Upton and Glasscock Counties).

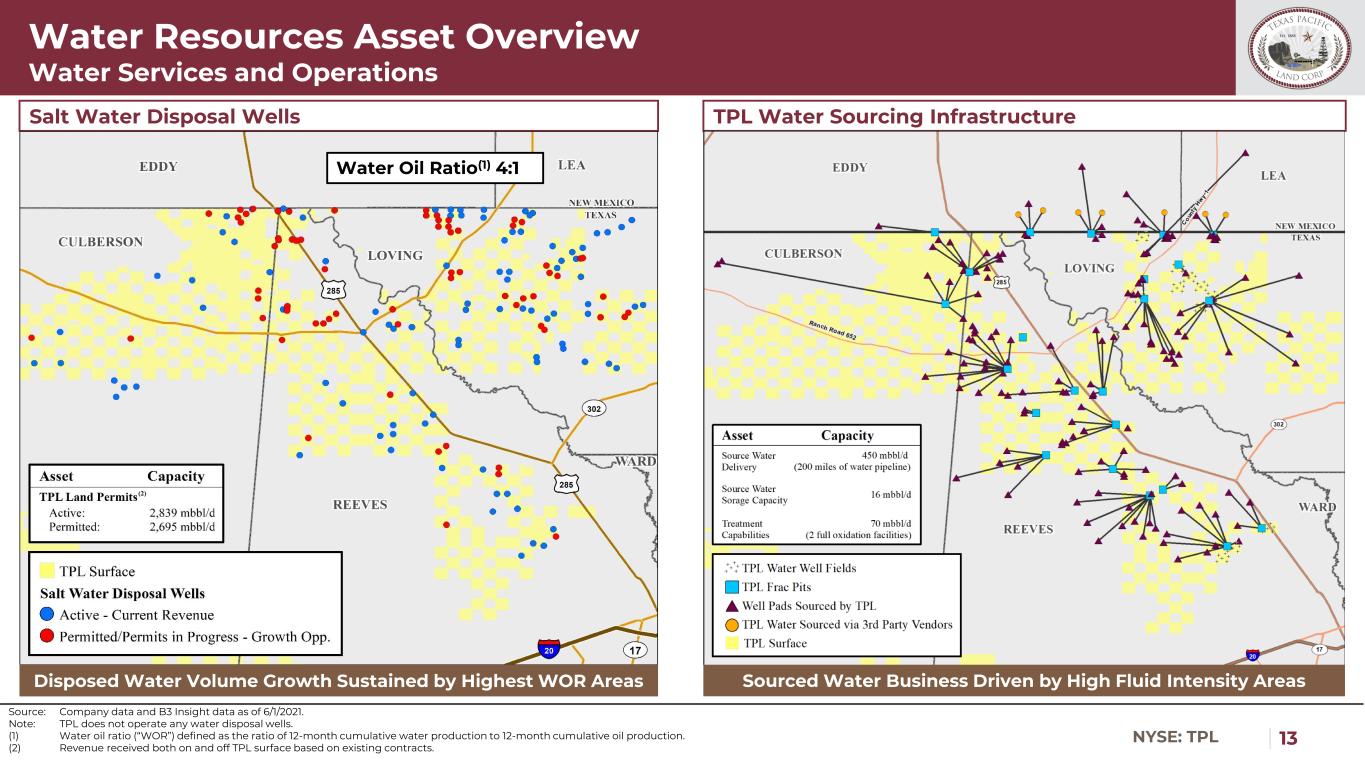

| 13NYSE: TPL Water Resources Asset Overview Water Services and Operations Source: Company data and B3 Insight data as of 6/1/2021. Note: TPL does not operate any water disposal wells. (1) Water oil ratio (“WOR”) defined as the ratio of 12-month cumulative water production to 12-month cumulative oil production. (2) Revenue received both on and off TPL surface based on existing contracts. Disposed Water Volume Growth Sustained by Highest WOR Areas Sourced Water Business Driven by High Fluid Intensity Areas UpdateSalt Water Disposal Wells Updated BB TPL Water Sourcing Infrastructure Water Oil Ratio(1) 4:1

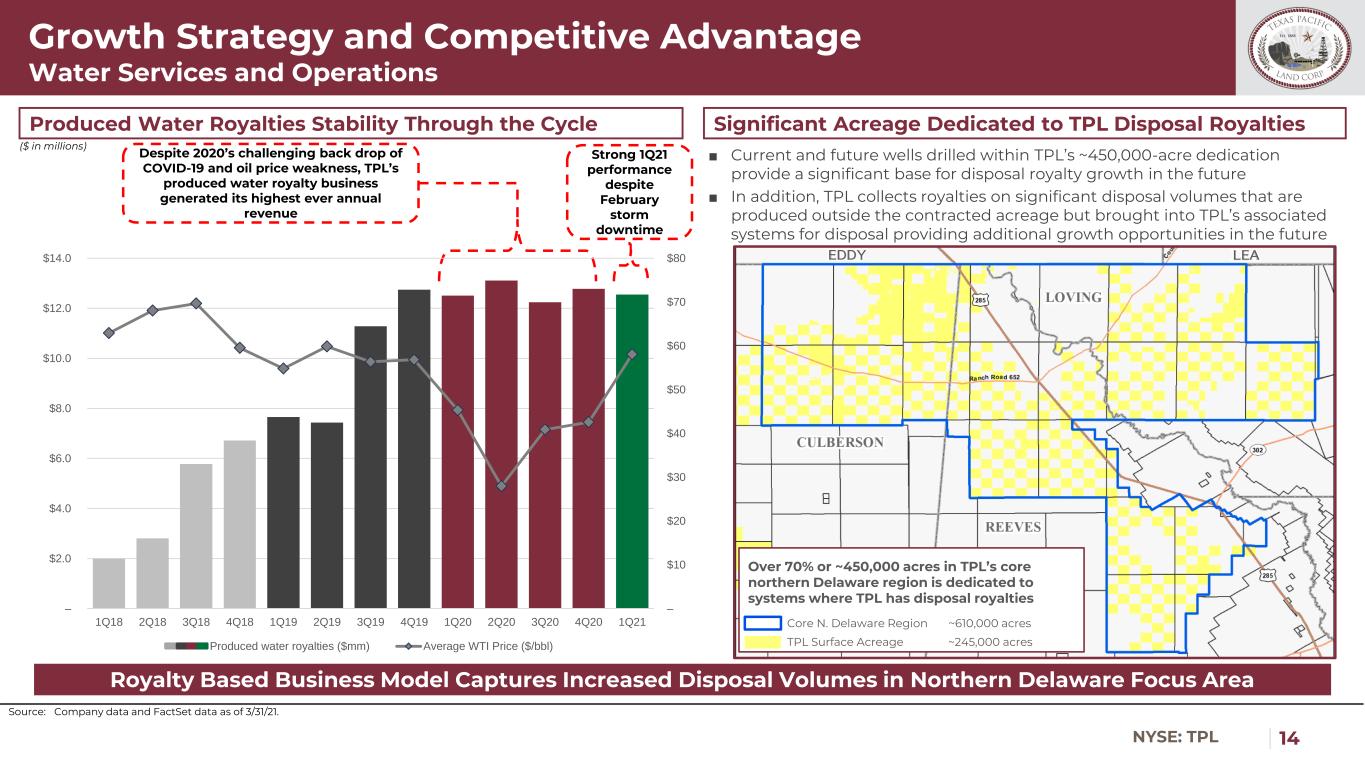

| 14NYSE: TPL Growth Strategy and Competitive Advantage Water Services and Operations Produced Water Royalties Stability Through the Cycle Significant Acreage Dedicated to TPL Disposal Royalties Source: Company data and FactSet data as of 3/31/21. ($ in millions) Royalty Based Business Model Captures Increased Disposal Volumes in Northern Delaware Focus Area Despite 2020’s challenging back drop of COVID-19 and oil price weakness, TPL’s produced water royalty business generated its highest ever annual revenue ■ Current and future wells drilled within TPL’s ~450,000-acre dedication provide a significant base for disposal royalty growth in the future ■ In addition, TPL collects royalties on significant disposal volumes that are produced outside the contracted acreage but brought into TPL’s associated systems for disposal providing additional growth opportunities in the future LEAEDDY Over 70% or ~450,000 acres in TPL’s core northern Delaware region is dedicated to systems where TPL has disposal royalties Core N. Delaware Region ~610,000 acres TPL Surface Acreage ~245,000 acres Strong 1Q21 performance despite February storm downtime – $10 $20 $30 $40 $50 $60 $70 $80 – $2.0 $4.0 $6.0 $8.0 $10.0 $12.0 $14.0 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 3Q20 4Q20 1Q21 Produced water royalties ($mm) Average WTI Price ($/bbl)

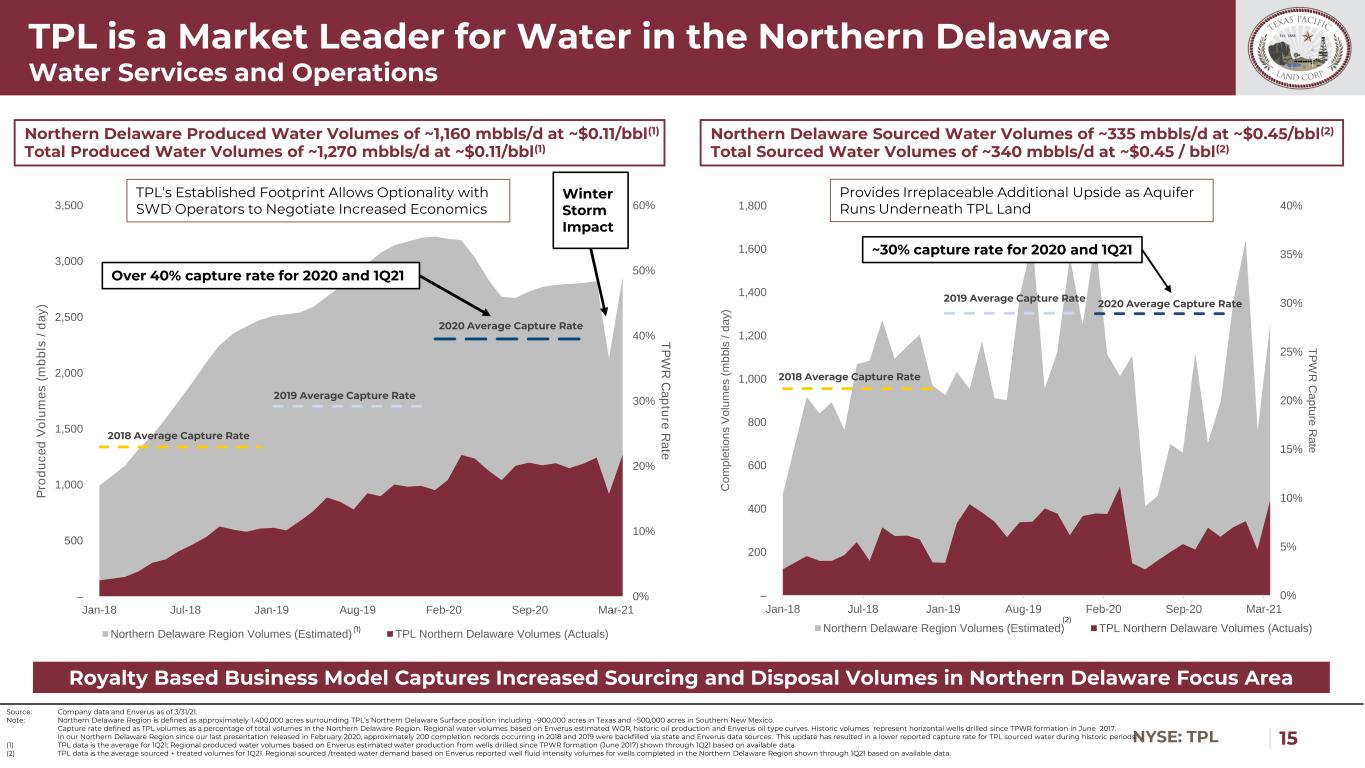

| 15NYSE: TPL 0% 5% 10% 15% 20% 25% 30% 35% 40% – 200 400 600 800 1,000 1,200 1,400 1,600 1,800 Jan-18 Jul-18 Jan-19 Aug-19 Feb-20 Sep-20 Mar-21 T P W R C a p tu re R a te C o m p le ti o n s V o lu m e s ( m b b ls / d a y ) Northern Delaware Region Volumes (Estimated) TPL Northern Delaware Volumes (Actuals) 0% 10% 20% 30% 40% 50% 60% – 500 1,000 1,500 2,000 2,500 3,000 3,500 Jan-18 Jul-18 Jan-19 Aug-19 Feb-20 Sep-20 Mar-21 T P W R C a p tu re R a te P ro d u c e d V o lu m e s ( m b b ls / d a y ) Northern Delaware Region Volumes (Estimated) TPL Northern Delaware Volumes (Actuals) Source: Company data and Enverus as of 3/31/21. Note: Northern Delaware Region is defined as approximately 1,400,000 acres surrounding TPL’s Northern Delaware Surface position including ~900,000 acres in Texas and ~500,000 acres in Southern New Mexico. Capture rate defined as TPL volumes as a percentage of total volumes in the Northern Delaware Region. Regional water volumes based on Enverus estimated WOR, historic oil production and Enverus oil type curves. Historic volumes represent horizontal wells drilled since TPWR formation in June 2017. In our Northern Delaware Region since our last presentation released in February 2020, approximately 200 completion records occurring in 2018 and 2019 were backfilled via state and Enverus data sources. This update has resulted in a lower reported capture rate for TPL sourced water during historic periods. (1) TPL data is the average for 1Q21; Regional produced water volumes based on Enverus estimated water production from wells drilled since TPWR formation (June 2017) shown through 1Q21 based on available data. (2) TPL data is the average sourced + treated volumes for 1Q21. Regional sourced /treated water demand based on Enverus reported well fluid intensity volumes for wells completed in the Northern Delaware Region shown through 1Q21 based on available data. TPL is a Market Leader for Water in the Northern Delaware Water Services and Operations Northern Delaware Produced Water Volumes of ~1,160 mbbls/d at ~$0.11/bbl(1) Total Produced Water Volumes of ~1,270 mbbls/d at ~$0.11/bbl(1) Northern Delaware Sourced Water Volumes of ~335 mbbls/d at ~$0.45/bbl(2) Total Sourced Water Volumes of ~340 mbbls/d at ~$0.45 / bbl(2) Provides Irreplaceable Additional Upside as Aquifer Runs Underneath TPL Land Royalty Based Business Model Captures Increased Sourcing and Disposal Volumes in Northern Delaware Focus Area (1) 2019 Average Capture Rate TPL’s Established Footprint Allows Optionality with SWD Operators to Negotiate Increased Economics (2) 2018 Average Capture Rate 2020 Average Capture Rate 2019 Average Capture Rate 2018 Average Capture Rate 2020 Average Capture Rate Over 40% capture rate for 2020 and 1Q21 ~30% capture rate for 2020 and 1Q21 Winter Storm Impact

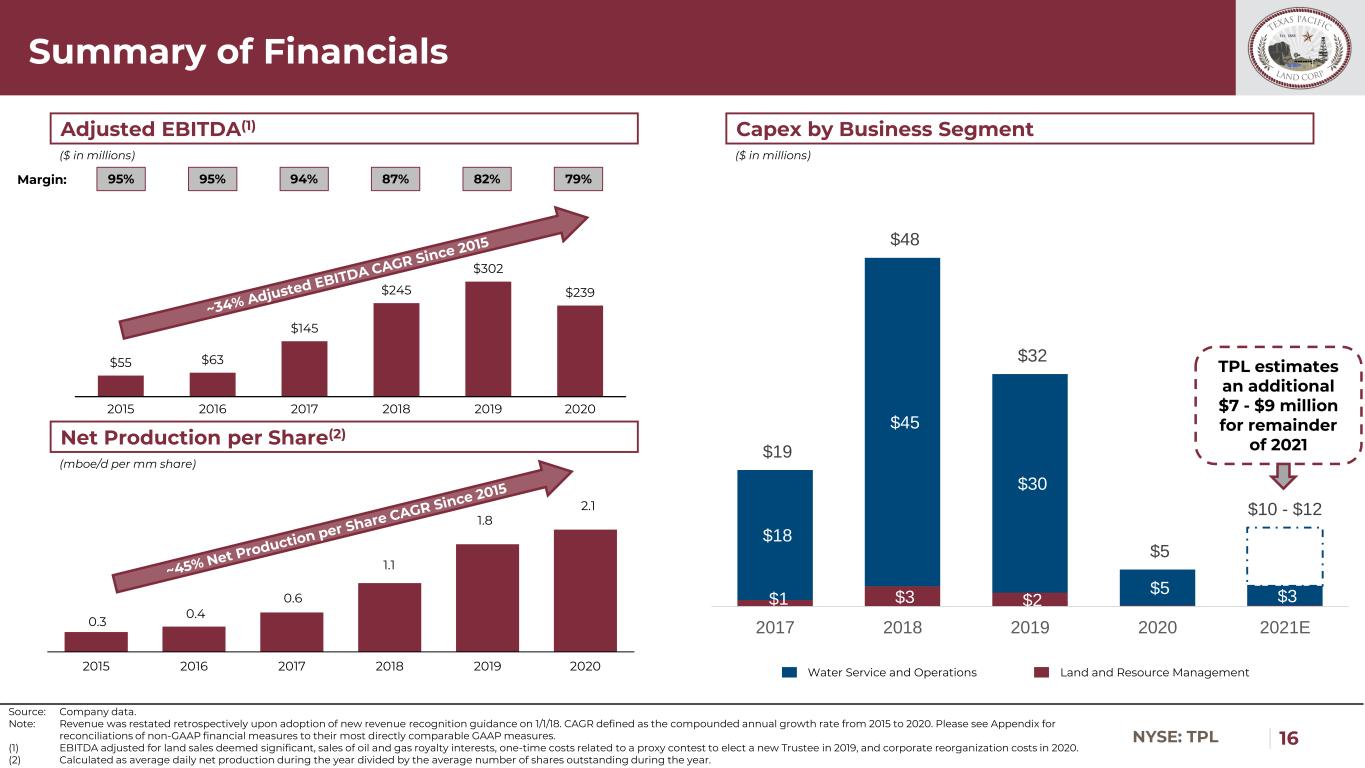

| 16NYSE: TPL $1 $3 $2 $18 $45 $30 $5 $3 $19 $48 $32 $5 $10 - $12 2017 2018 2019 2020 2021E0.3 0.4 0.6 1.1 1.8 2.1 2015 2016 2017 2018 2019 2020 $55 $63 $145 $245 $302 $239 2015 2016 2017 2018 2019 2020 Summary of Financials Source: Company data. Note: Revenue was restated retrospectively upon adoption of new revenue recognition guidance on 1/1/18. CAGR defined as the compounded annual growth rate from 2015 to 2020. Please see Appendix for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures. (1) EBITDA adjusted for land sales deemed significant, sales of oil and gas royalty interests, one-time costs related to a proxy contest to elect a new Trustee in 2019, and corporate reorganization costs in 2020. (2) Calculated as average daily net production during the year divided by the average number of shares outstanding during the year. Net Production per Share(2) Adjusted EBITDA(1) ($ in millions) 95% 95% 94% 87% 79%Margin: Capex by Business Segment ($ in millions) (mboe/d per mm share) Water Service and Operations Land and Resource Management 82% TPL estimates an additional $7 - $9 million for remainder of 2021

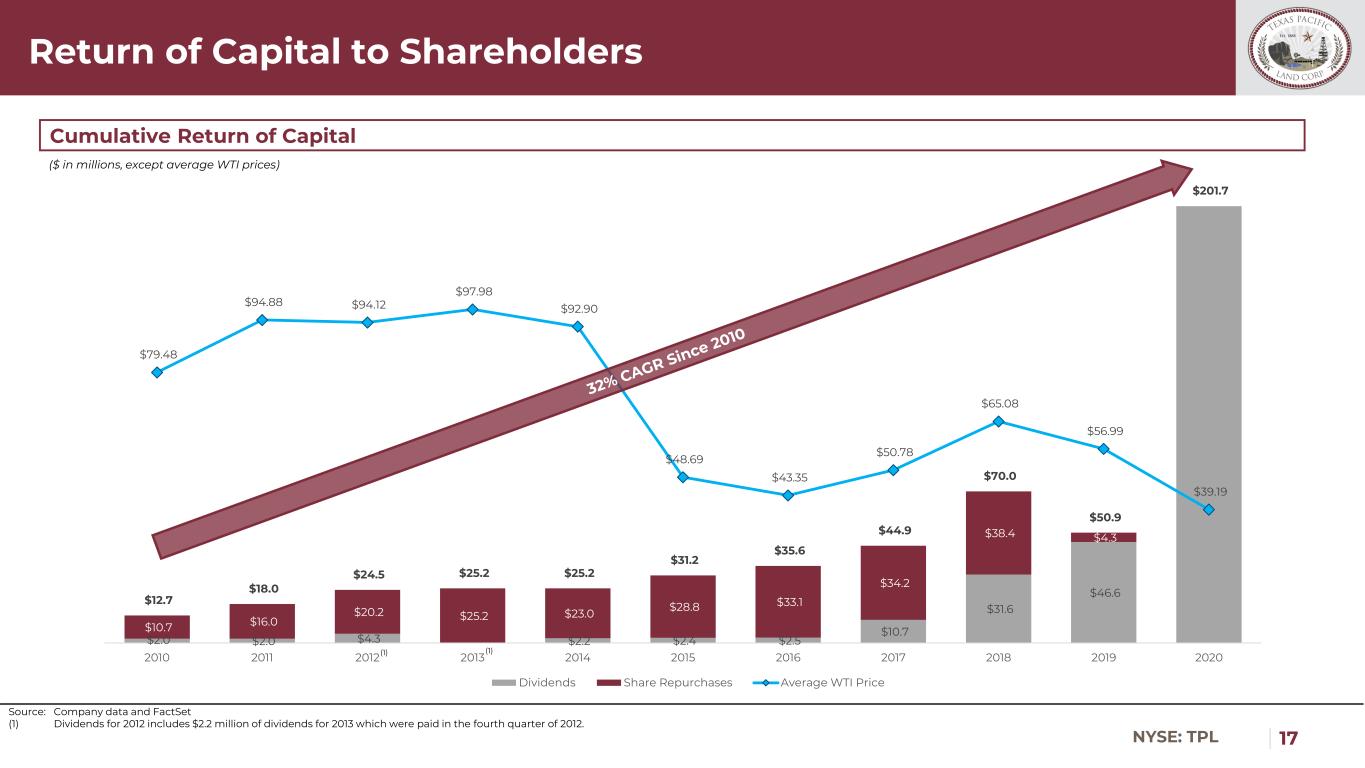

| 17NYSE: TPL $2.0 $2.0 $4.3 $2.2 $2.4 $2.5 $10.7 $31.6 $46.6 $10.7 $16.0 $20.2 $25.2 $23.0 $28.8 $33.1 $34.2 $38.4 $4.3 $12.7 $18.0 $24.5 $25.2 $25.2 $31.2 $35.6 $44.9 $70.0 $50.9 $201.7 $79.48 $94.88 $94.12 $97.98 $92.90 $48.69 $43.35 $50.78 $65.08 $56.99 $39.19 – $20.00 $40.00 $60.00 $80.00 $100.00 $120.00 $140.00 – $50.0 $100.0 $150.0 $200.0 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Dividends Share Repurchases Average WTI Price Return of Capital to Shareholders Source: Company data and FactSet (1) Dividends for 2012 includes $2.2 million of dividends for 2013 which were paid in the fourth quarter of 2012. Cumulative Return of Capital ($ in millions, except average WTI prices) (1) (1)

| 18NYSE: TPL An Unmatched Oil and Gas Investment Source: FactSet. (1) Based on FactSet compounded total shareholder return from April 2011 to March 2021. Sustained Profitability and Pristine Balance Sheet Focus on Return On and Of Capital ETF of the Permian Basin Significant Upside Synergistic Business Segments Performance Through the Cycle Summary Investment Highlights (Composite) WTI Oil S&P Oil & Gas E&P Index 10-year Average Annual Total Return(1) -10% -6% 14% 18% 44%

Appendix

| 20NYSE: TPL Texas Pacific Land Corporation Team Track Record of Shareholder Value Creation Texas Pacific Land Corporation Texas Pacific Water Resources Jeremy Smith VP, Business Development Tyler Glover President and CEO Chris Steddum CFO Robert A. Crain EVP Mr. Steddum came to TPL from Stifel’s oil and gas investment banking team where he served as a Director. Mr. Steddum began his investment banking career in the O&G coverage group at Credit Suisse. He earned his MBA from Rice University and Bachelors of Science in Business Administration from the University of South Carolina Honors College. Robert Crain has served as Executive Vice President of Texas Pacific Water Resources since its formation in June 2017. Prior to TPWR, Mr. Crain led water resource development efforts for EOG Resources across multiple basins, including the Permian and Eagle Ford. Mr. Crain holds Bachelor of Science Degree from Texas State University and M.B.A. from University of Texas at Tyler. Mr. Smith came to Texas Pacific Water Resources from EOG Resources where he negotiated water sourcing and purchasing agreements across the Permian Basin and the Eagle Ford. Prior to EOG, Mr. Smith led a successful real estate broker service. Katie Keenan VP, Assistant General Counsel Mr. Glover serves as TPL’s President and Chief Executive Officer. He served as Chief Executive Officer, Co-General Agent and Secretary of the Trust from November 2016 to January 11, 2021. Mr. Glover also currently serves as President and Chief Executive Officer of TPWR. Previously, Mr. Glover served as Assistant General Agent of the Trust and an independent landman in the Permian prior thereto. Micheal W. Dobbs SVP, General Counsel Mr. Dobbs came to TPL from Kelley Drye & Warren LLP where he was a Partner with the firm. Mr. Dobbs has over two decades of experience with property and mineral rights, water rights, easements and leasehold negotiations. He earned his J.D. from the University of Houston and his Bachelor of Science in Rangeland Ecology and Management from Texas A&M and is a licensed attorney in the State of Texas. Ms. Keenan came to TPL in January 2017 and transitioned to Vice President, Land and Legal at Texas Pacific Water Resources. She now serves as Vice President and Assistant Counsel working with TPWR. Previously, Ms. Keenan worked as a Landman for BHP Billiton in the Permian Basin. She earned her law degree from the University of Oklahoma and is a licensed attorney in the State of Texas. Stephanie Buffington CAO Ms. Buffington came to TPL from Monogram Residential Trust, a publicly traded REIT, where she served as Vice President of Financial Reporting. Ms. Buffington has over two decades of public company experience and began her career at KPMG. She earned her Bachelors of Business Administration in Accounting from the University of Texas at Arlington and is a licensed Certified Public Accountant in the State of Texas.

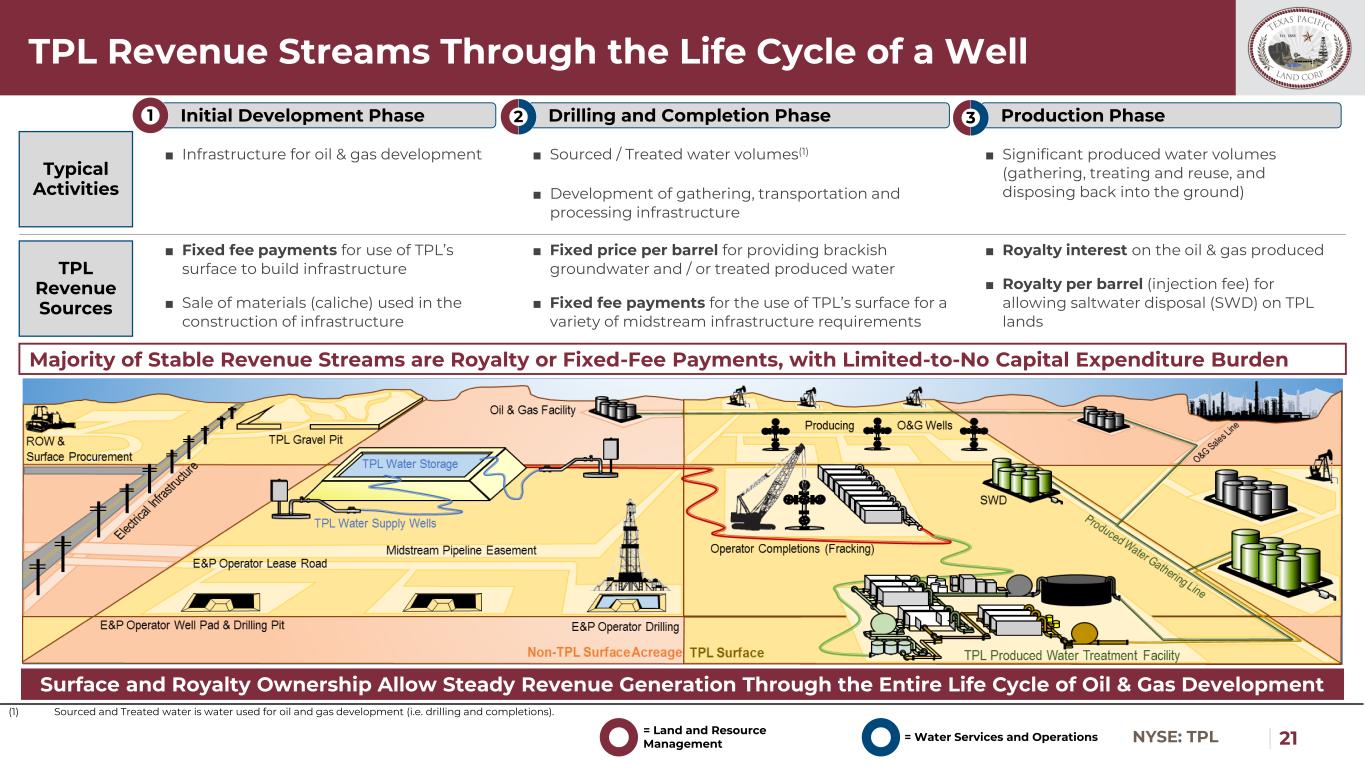

| 21NYSE: TPL TPL Revenue Streams Through the Life Cycle of a Well Surface and Royalty Ownership Allow Steady Revenue Generation Through the Entire Life Cycle of Oil & Gas Development ■ Infrastructure for oil & gas development Initial Development Phase Drilling and Completion Phase Production Phase Typical Activities TPL Revenue Sources ■ Fixed fee payments for use of TPL’s surface to build infrastructure ■ Sale of materials (caliche) used in the construction of infrastructure ■ Sourced / Treated water volumes(1) ■ Development of gathering, transportation and processing infrastructure ■ Fixed price per barrel for providing brackish groundwater and / or treated produced water ■ Fixed fee payments for the use of TPL’s surface for a variety of midstream infrastructure requirements ■ Significant produced water volumes (gathering, treating and reuse, and disposing back into the ground) ■ Royalty interest on the oil & gas produced ■ Royalty per barrel (injection fee) for allowing saltwater disposal (SWD) on TPL lands Majority of Stable Revenue Streams are Royalty or Fixed-Fee Payments, with Limited-to-No Capital Expenditure Burden 1 2 = Land and Resource Management = Water Services and Operations 3 (1) Sourced and Treated water is water used for oil and gas development (i.e. drilling and completions).

| 22NYSE: TPL Well Positioned Assets Attract Increasing Development Focus Land and Resource Management Source: Company data and Enverus. Note: TPL production growth giving effect to our portfolio of ~23,700 net royalty acres in the Permian Basin as of 3/31/21 as if it had been owned since 1/1/14. (1) DUCs considered to be all wells awaiting completion. DUC values shown as of period end date. Horizontal wells only. Average Net Production (mboed) Gross DUC Inventory(1) Near-term Royalty Production is Supported by Robust DUC Inventory Held by Well Capitalized E&P Operators 1.7 2.7 3.3 5.1 8.8 13.7 16.2 16.4 2014 2015 2016 2017 2018 2019 2020 1Q21 71 107 121 319 362 486 531 541 2014 2015 2016 2017 2018 2019 2020 1Q21

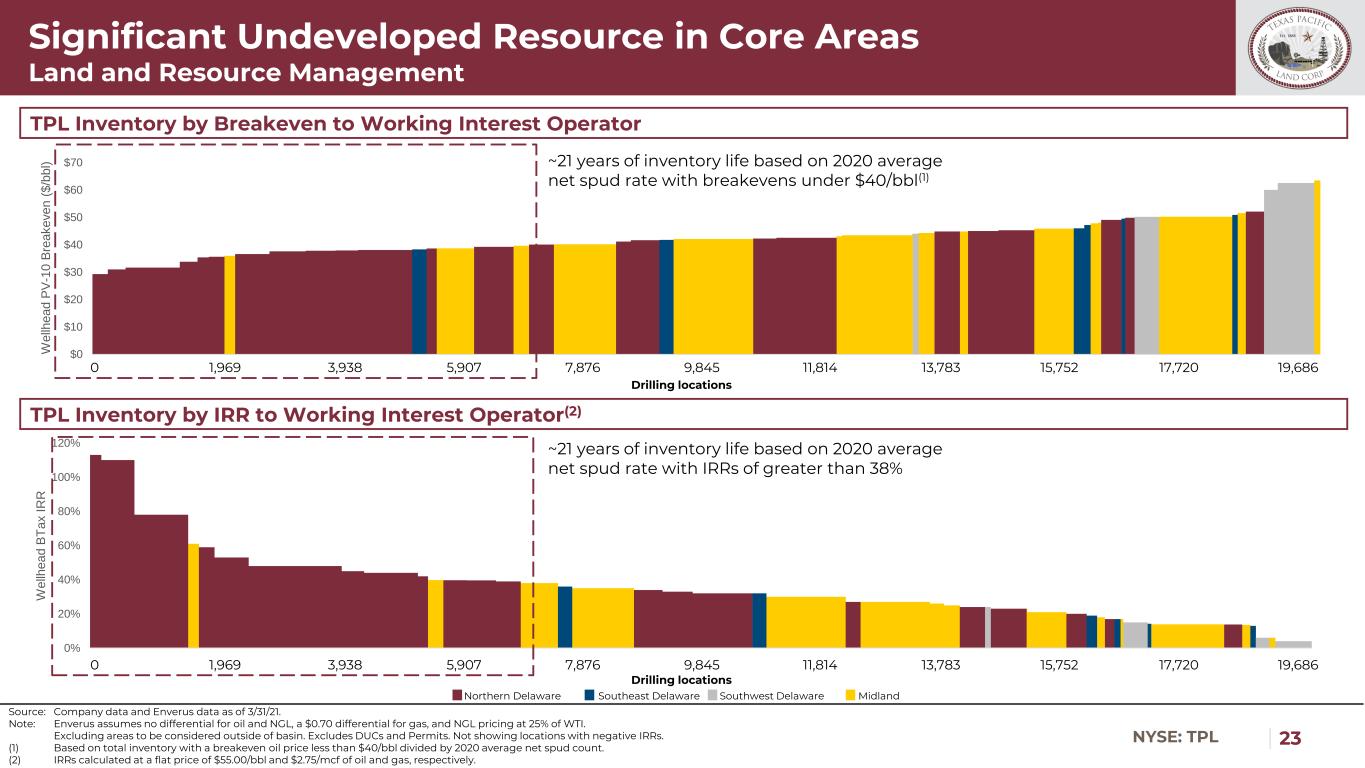

| 23NYSE: TPL 0% 20% 40% 60% 80% 100% 120% 1 626 1,251 1,876 2,501 3,126 3,751 4,376 5,001 5,626 6,251 6,876 7,501 8,126 8,751 9,376 10,001 10,626 11,251 11,876 12,501 13,126 13,751 14,376 15,001 15,626 16,251 16,876 17,501 18,126 18,751 19,376 W e ll h e a d B T a x I R R $0 $10 $20 $30 $40 $50 $60 $70 1 626 1,251 1,876 2,501 3,126 3,751 4,376 5,001 5,626 6,251 6,876 7,501 8,126 8,751 9,376 10,001 10,626 11,251 11,876 12,501 13,126 13,751 14,376 15,001 15,626 16,251 16,876 17,501 18,126 18,751 19,376 W e ll h e a d P V -1 0 B re a k e v e n ( $ /b b l) Significant Undeveloped Resource in Core Areas Land and Resource Management TPL Inventory by Breakeven to Working Interest Operator TPL Inventory by IRR to Working Interest Operator(2) Source: Company data and Enverus data as of 3/31/21. Note: Enverus assumes no differential for oil and NGL, a $0.70 differential for gas, and NGL pricing at 25% of WTI. Excluding areas to be considered outside of basin. Excludes DUCs and Permits. Not showing locations with negative IRRs. (1) Based on total inventory with a breakeven oil price less than $40/bbl divided by 2020 average net spud count. (2) IRRs calculated at a flat price of $55.00/bbl and $2.75/mcf of oil and gas, respectively. Northern Delaware Southeast Delaware Southwest Delaware Midland ~21 years of inventory life based on 2020 average net spud rate with breakevens under $40/bbl(1) ~21 years of inventory life based on 2020 average net spud rate with IRRs of greater than 38% Drilling locations Drilling locations 0 1,969 3,938 5,907 7, 76 9,845 1,814 1 ,783 15,752 17,720 19, 86 0 1,969 3,938 5,907 7,876 9,845 11,814 13,783 15,752 17,720 19,686

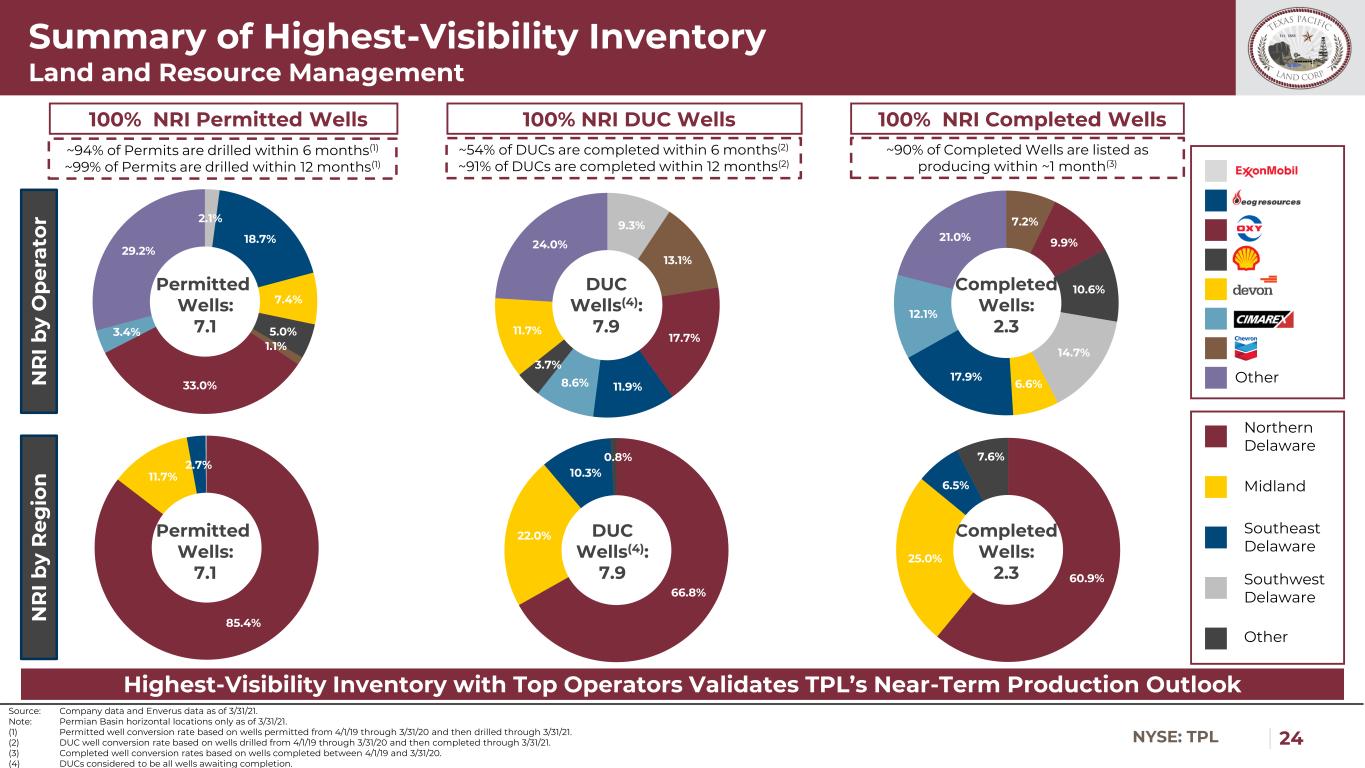

| 24NYSE: TPL 66.8% 22.0% 10.3% 0.8% Summary of Highest-Visibility Inventory Land and Resource Management Source: Company data and Enverus data as of 3/31/21. Note: Permian Basin horizontal locations only as of 3/31/21. (1) Permitted well conversion rate based on wells permitted from 4/1/19 through 3/31/20 and then drilled through 3/31/21. (2) DUC well conversion rate based on wells drilled from 4/1/19 through 3/31/20 and then completed through 3/31/21. (3) Completed well conversion rates based on wells completed between 4/1/19 and 3/31/20. (4) DUCs considered to be all wells awaiting completion. Highest-Visibility Inventory with Top Operators Validates TPL’s Near-Term Production Outlook Other Northern Delaware Other Midland Southeast Delaware Southwest Delaware 100% NRI Permitted Wells ~94% of Permits are drilled within 6 months(1) ~99% of Permits are drilled within 12 months(1) Permitted Wells: 7.1 100% NRI DUC Wells ~54% of DUCs are completed within 6 months(2) ~91% of DUCs are completed within 12 months(2) DUC Wells(4): 7.9 100% NRI Completed Wells ~90% of Completed Wells are listed as producing within ~1 month(3) Completed Wells: 2.3 N R I b y O p e ra to r N R I b y R e g io n Permitted Wells: 7.1 Completed Wells: 2.3 DUC Wells(4): 7.9 2.1% 18.7% 7.4% 5.0% 1.1% 33.0% 3.4% 29.2% 85.4% 11.7% 2.7% 9.3% 13.1% 17.7% 11.9%8.6% 3.7% 11.7% 24.0% 7.2% 9.9% 10.6% 14.7% 6.6% 17.9% 12.1% 21.0% 60.9% 25.0% 6.5% 7.6%

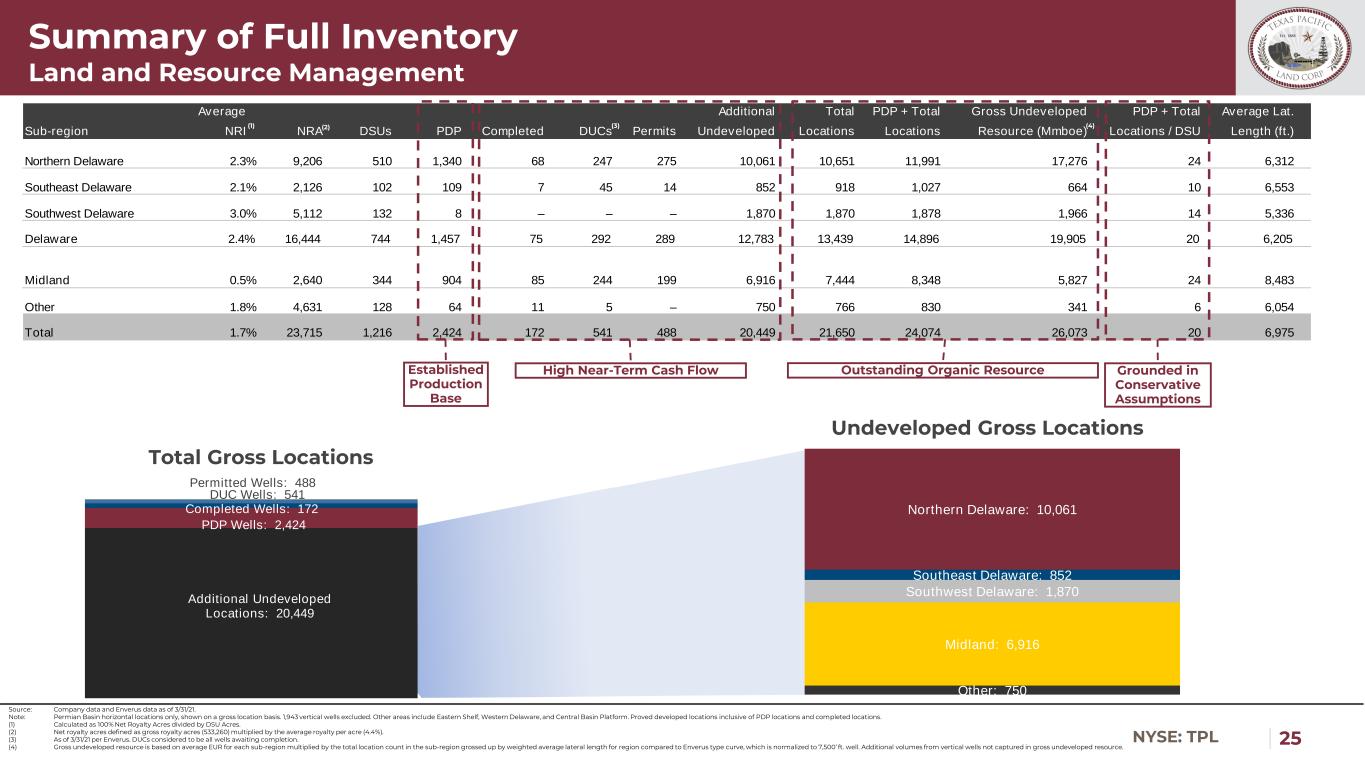

| 25NYSE: TPL Average Additional Total PDP + Total Gross Undeveloped PDP + Total Average Lat. Sub-region NRI NRA DSUs PDP Completed DUCs Permits Undeveloped Locations Locations Resource (Mmboe) Locations / DSU Length (ft.) Northern Delaware 2.3% 9,206 510 1,340 68 247 275 10,061 10,651 11,991 17,276 24 6,312 Southeast Delaware 2.1% 2,126 102 109 7 45 14 852 918 1,027 664 10 6,553 Southwest Delaware 3.0% 5,112 132 8 – – – 1,870 1,870 1,878 1,966 14 5,336 Delaware 2.4% 16,444 744 1,457 75 292 289 12,783 13,439 14,896 19,905 20 6,205 Midland 0.5% 2,640 344 904 85 244 199 6,916 7,444 8,348 5,827 24 8,483 Other 1.8% 4,631 128 64 11 5 – 750 766 830 341 6 6,054 Total 1.7% 23,715 1,216 2,424 172 541 488 20,449 21,650 24,074 26,073 20 6,975 Summary of Full Inventory Land and Resource Management Total Gross Locations Undeveloped Gross Locations Source: Company data and Enverus data as of 3/31/21. Note: Permian Basin horizontal locations only, shown on a gross location basis. 1,943 vertical wells excluded. Other areas include Eastern Shelf, Western Delaware, and Central Basin Platform. Proved developed locations inclusive of PDP locations and completed locations. (1) Calculated as 100% Net Royalty Acres divided by DSU Acres. (2) Net royalty acres defined as gross royalty acres (533,260) multiplied by the average royalty per acre (4.4%). (3) As of 3/31/21 per Enverus. DUCs considered to be all wells awaiting completion. (4) Gross undeveloped resource is based on average EUR for each sub-region multiplied by the total location count in the sub-region grossed up by weighted average lateral length for region compared to Enverus type curve, which is normalized to 7,500’ ft. well. Additional volumes from vertical wells not captured in gross undeveloped resource. Established Production Base Grounded in Conservative Assumptions High Near-Term Cash Flow Outstanding Organic Resource (1) (2) (3) (4) Additional Undeveloped Locations: 20,449 PDP Wells: 2,424 DUC Wells: 541 Permitted Wells: 488 Completed Wells: 172 Other: 750 Midland: 6,916 Southwest Delaware: 1,870 Southeast Delaware: 852 Northern Delaware: 10,061

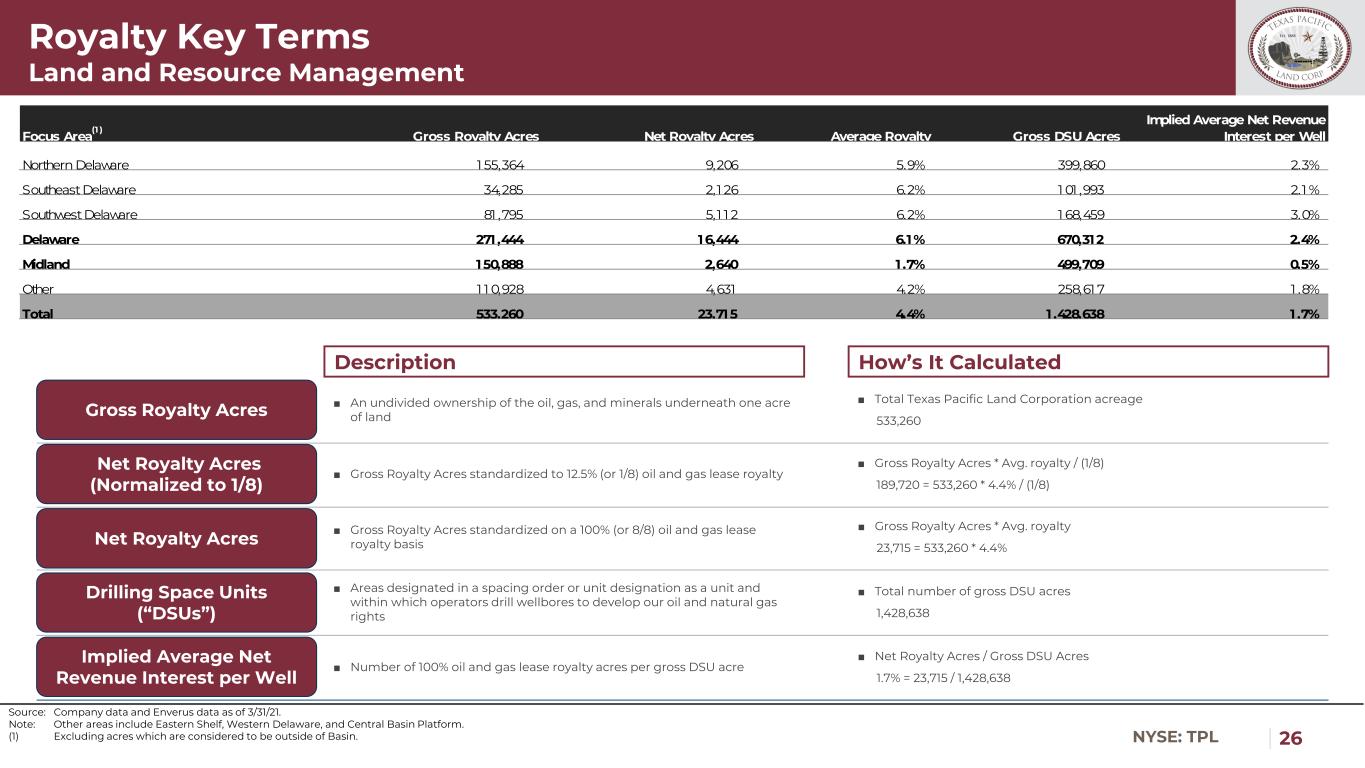

| 26NYSE: TPL Gross Royalty Acres Royalty Key Terms Land and Resource Management Net Royalty Acres (Normalized to 1/8) Net Royalty Acres Drilling Space Units (“DSUs”) Implied Average Net Revenue Interest per Well Description How’s It Calculated ■ An undivided ownership of the oil, gas, and minerals underneath one acre of land ■ Total Texas Pacific Land Corporation acreage 533,260 ■ Gross Royalty Acres standardized to 12.5% (or 1/8) oil and gas lease royalty ■ Gross Royalty Acres standardized on a 100% (or 8/8) oil and gas lease royalty basis ■ Areas designated in a spacing order or unit designation as a unit and within which operators drill wellbores to develop our oil and natural gas rights ■ Number of 100% oil and gas lease royalty acres per gross DSU acre ■ Gross Royalty Acres * Avg. royalty / (1/8) 189,720 = 533,260 * 4.4% / (1/8) ■ Gross Royalty Acres * Avg. royalty 23,715 = 533,260 * 4.4% ■ Total number of gross DSU acres 1,428,638 ■ Net Royalty Acres / Gross DSU Acres 1.7% = 23,715 / 1,428,638 Source: Company data and Enverus data as of 3/31/21. Note: Other areas include Eastern Shelf, Western Delaware, and Central Basin Platform. (1) Excluding acres which are considered to be outside of Basin. Focus Area (1 ) Gross Royalty Acres Net Royalty Acres Average Royalty Gross DSU Acres Implied Average Net Revenue Interest per Well Northern Delaware 1 55,364 9,206 5.9% 399,860 2.3% Southeast Delaware 34,285 2,1 26 6.2% 1 01 ,993 2.1 % Southwest Delaware 81 ,795 5,1 1 2 6.2% 1 68,459 3.0% Delaware 271 ,444 16,444 6.1% 670,312 2.4% Midland 150,888 2,640 1 .7% 499,709 0.5% Other 1 1 0,928 4,631 4.2% 258,61 7 1 .8% Total 533,260 23,715 4.4% 1 ,428,638 1 .7%

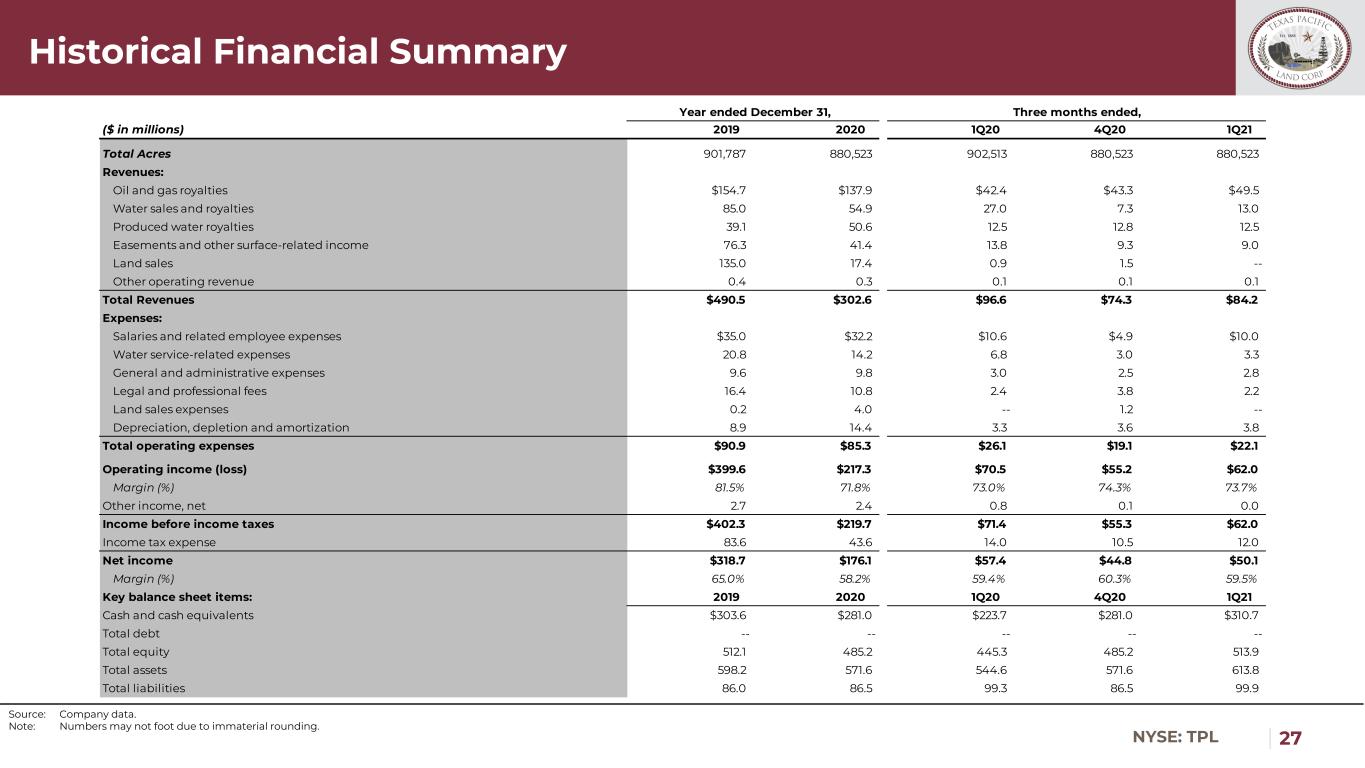

| 27NYSE: TPL Historical Financial Summary Source: Company data. Note: Numbers may not foot due to immaterial rounding. Year ended December 31, Three months ended, ($ in millions) 2019 2020 1Q20 4Q20 1Q21 Total Acres 901,787 880,523 902,513 880,523 880,523 Revenues: Oil and gas royalties $154.7 $137.9 $42.4 $43.3 $49.5 Water sales and royalties 85.0 54.9 27.0 7.3 13.0 Produced water royalties 39.1 50.6 12.5 12.8 12.5 Easements and other surface-related income 76.3 41.4 13.8 9.3 9.0 Land sales 135.0 17.4 0.9 1.5 -- Other operating revenue 0.4 0.3 0.1 0.1 0.1 Total Revenues $490.5 $302.6 $96.6 $74.3 $84.2 Expenses: Salaries and related employee expenses $35.0 $32.2 $10.6 $4.9 $10.0 Water service-related expenses 20.8 14.2 6.8 3.0 3.3 General and administrative expenses 9.6 9.8 3.0 2.5 2.8 Legal and professional fees 16.4 10.8 2.4 3.8 2.2 Land sales expenses 0.2 4.0 -- 1.2 -- Depreciation, depletion and amortization 8.9 14.4 3.3 3.6 3.8 Total operating expenses $90.9 $85.3 $26.1 $19.1 $22.1 Operating income (loss) $399.6 $217.3 $70.5 $55.2 $62.0 Margin (%) 81.5% 71.8% 73.0% 74.3% 73.7% Other income, net 2.7 2.4 0.8 0.1 0.0 Income before income taxes $402.3 $219.7 $71.4 $55.3 $62.0 Income tax expense 83.6 43.6 14.0 10.5 12.0 Net income $318.7 $176.1 $57.4 $44.8 $50.1 Margin (%) 65.0% 58.2% 59.4% 60.3% 59.5% Key balance sheet items: 2019 2020 1Q20 4Q20 1Q21 Cash and cash equivalents $303.6 $281.0 $223.7 $281.0 $310.7 Total debt -- -- -- -- -- Total equity 512.1 485.2 445.3 485.2 513.9 Total assets 598.2 571.6 544.6 571.6 613.8 Total liabilities 86.0 86.5 99.3 86.5 99.9

| 28NYSE: TPL Non-GAAP Reconciliations Source: Company data. Note: Numbers may not foot due to immaterial rounding. (1) Land swap of ~$22 million in 4Q19, and sale to WPX in 1Q19 of ~$100 million. (2) Sale of nonparticipating perpetual oil and gas royalty interest in approximately 812 net royalty acres (1/8th interest) of ~$19 million in 4Q19. (3) Costs related to proxy contest to elect a new Trustee, settlement agreement and corporate reorganization. (4) Excludes land sales deemed significant and sales of oil and gas royalty interests. Land and Resource Management Water Services and Operations Total Year ended December 31, Three months ended, Three months ended, ($ in millions) 2015 2016 2017 2018 2019 2020 2Q20 3Q20 4Q20 1Q21 March 31, 2021 March 31, 2021 March 31, 2021 Net income $50.0 $42.3 $97.2 $209.7 $318.7 $176.1 $27.6 $46.3 $44.8 $50.1 $39.5 $10.5 $50.1 Adjustments: Income taxes 25.2 20.6 47.8 52.0 83.6 43.6 7.3 11.8 10.5 12.0 9.0 2.9 12.0 Depreciation, depletion and amortization 0.0 0.0 0.4 2.6 8.9 14.4 3.7 3.8 3.6 3.8 0.5 3.3 3.8 EBITDA $75.3 $62.9 $145.4 $264.3 $411.2 $234.1 $38.6 $61.8 $59.0 $65.9 $49.0 $16.8 $65.9 Revenue $78.1 $66.1 $154.6 $300.2 $490.5 $302.6 $57.3 $74.4 $74.3 $84.2 $57.8 $26.4 $84.2 EBITDA Margin 96.4% 95.2% 94.0% 88.0% 83.8% 77.4% 67.4% 83.1% 79.3% 78.3% 84.9% 63.8% 78.3% Adjusted EBITDA: EBITDA $75.3 $62.9 $145.4 $264.3 $411.2 $234.1 $38.6 $61.8 $59.0 $65.9 $49.0 $16.8 $65.9 Other Adjustments: Less: land sales deemed significant(1) (19.8) -- -- -- (122.0) -- -- -- -- -- -- -- -- Less: sale of oil and gas royalty interests(2) -- -- -- (18.9) -- -- -- -- -- -- -- -- -- Add: proxy contests, settlement, and corporate reorganization costs(3) -- -- -- -- 13.0 5.1 2.0 0.5 2.2 2.0 2.0 -- 2.0 Adjusted EBITDA $55.5 $62.9 $145.4 $245.4 $302.2 $239.1 $40.6 $62.3 $61.2 $67.9 $51.0 $16.8 $67.9 Adjusted Revenue(4) $58.3 $66.1 $154.6 $281.3 $368.5 $302.6 $57.3 $74.4 $74.3 $84.2 $57.8 $26.4 $84.2 Adjusted EBITDA Margin 95.2% 95.2% 94.0% 87.2% 82.0% 79.0% 70.9% 83.8% 82.3% 80.6% 88.3% 63.8% 80.6%

1700 Pacific Avenue, Suite 2900 Dallas, Texas 75201 Texas Pacific Land Corporation