Position on Climate Change

TPL is dedicated to reducing our GHG emissions through a series of electrification projects and capital expenditure commitments. For example, the Company continues to prioritize the electrification of our water assets to reduce reliance on diesel and to manage our emissions profile. In 2022 we expanded our Renewables Team, a team created to solely focus on encouraging wind and solar development on our properties and exploring all available options to increase our existing renewable footprint. Finally, TPL allows for easements on our land to construct electricity infrastructure, supporting oil and gas operators’ access to electricity and thus avoiding the use of diesel to power their operations. This supports a tremendous amount of emissions reductions from operators across TPL’s land. Additionally, the Company’s water infrastructure—used to transport water—takes commercial trucks off the road. Each truck runs off of diesel, so for every truck that is removed due to TPL’s water infrastructure, the Company is supporting GHG reductions for its operators. Additionally, within our water business, TPL facilitates the development of infrastructure to provide water midstream services that enable the gathering, reuse, and recycling of produced water. Our water recycling capabilities help operators minimize the use of freshwater demand. This business offering is critical to support the risk of water availability that is associated with climate change.

Climate Risk Management—TCFD Reporting*

Texas Pacific Land Corporation (TPL) is unique when it comes to environmental sustainability, particularly as it applies to surface interactions with oil and gas exploration and production companies ("E&P"). Aside from the Company’s water solutions business, we do not directly develop or operate the infrastructure on our lands, and the majority of our assets do not include mineral rights. As a result, TPL has limited influence over E&P operations on our lands. Nevertheless, we maintain close relationships with our lessees and operators to support and encourage sustainable operating practices that align with our Environmental, Social, and Governance (“ESG”) goals and targets. We recognize the growing importance of the energy alternatives and the role that renewable energy resources play in shaping the future of global energy production. We feel that our land holding uniquely positions us to promote and inspire innovation towards cleaner and more responsible practices across the energy market.

Our approach to managing climate change risks and opportunities aligns with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD).

Governance

Board Oversight of Climate Risks

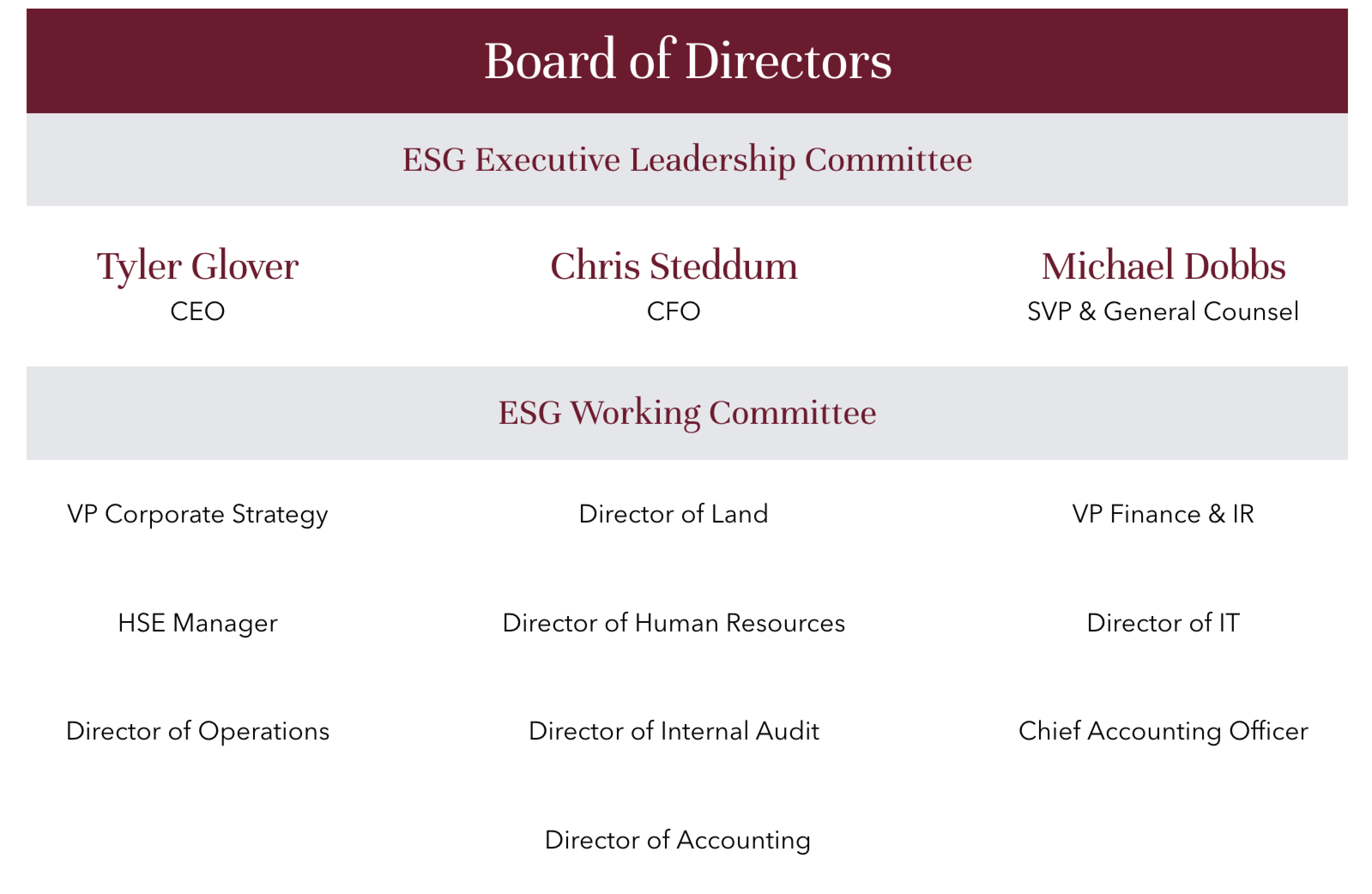

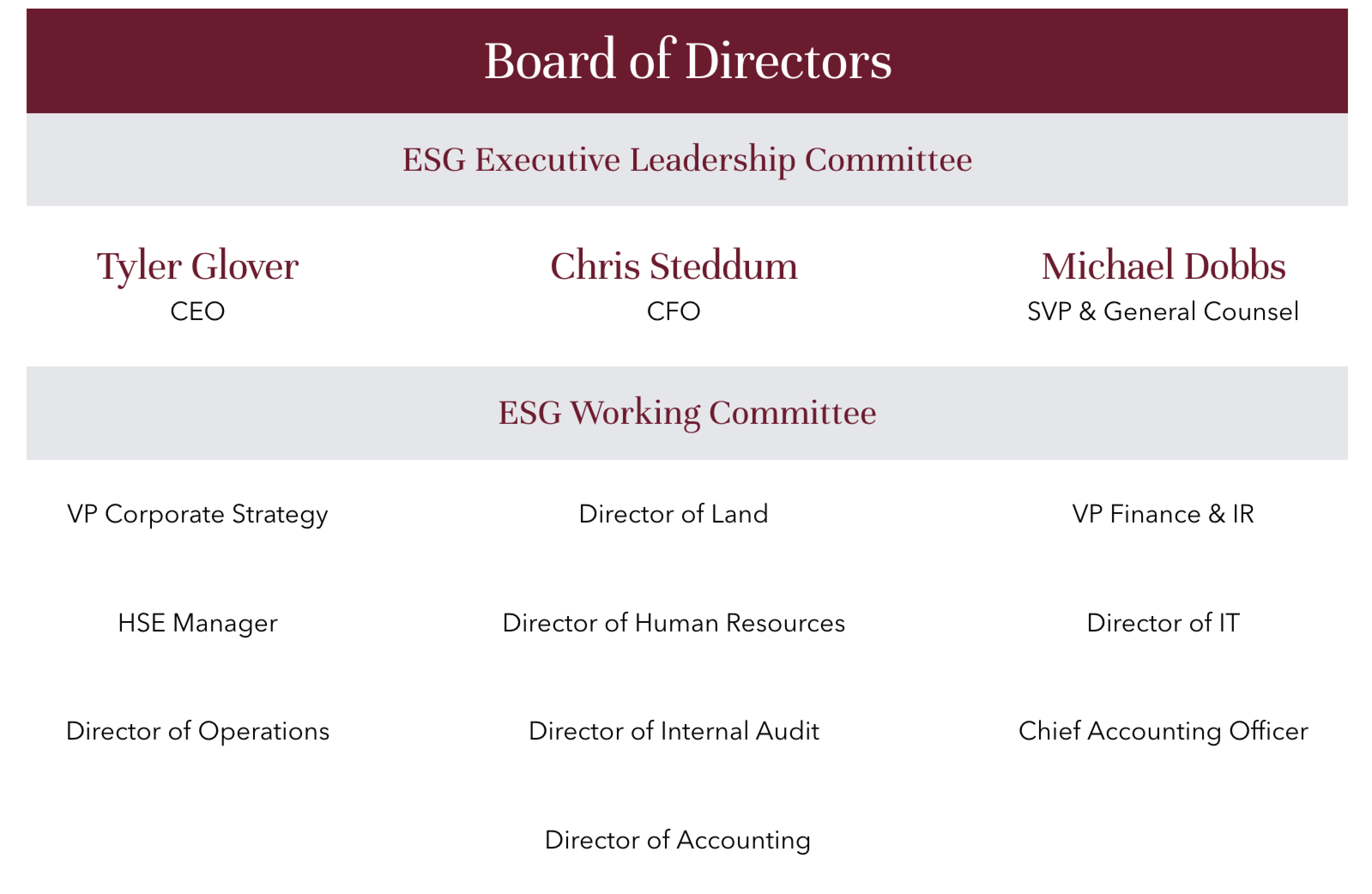

Our Board of Directors is responsible for overseeing the Company’s operations: including its strategy, risk management, and performance of management, to assure alignment with the interests of our stockholders. They also work to ensure our strategic business operations are conducted in accordance with our ESG program standards, which include climate change risk management.

The Board has three standing committees that meet quarterly and on an as-needed basis to help oversee the Company’s business: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Each board committee member brings distinguished skills and capabilities enabling oversight of sustainability and ESG goals, however oversight of climate change risks and opportunities rests within our Nominating and Corporate Governance Committee. They ensure TPL’s ESG and climate programs are conducted with the highest levels of integrity and responsibility. This Committee’s charter stipulates that it will “review the Company’s policies and programs concerning corporate social responsibility, including environmental, social and governance (ESG) matters.” This Committee “provides guidance to the Board and management with respect to trends and developments regarding environmental, social, environmental and political matters that could significantly impact the Company."

Management’s Role in Assessing and Managing Climate Risks and Opportunities

TPL’s ESG Leadership Committee provides critical oversight and direction regarding our ESG and climate-related business strategies. Our CEO, CFO and Senior Vice President & General Counsel are members of this Committee.

Our ESG Working Committee reports to the CEO and is led by our Vice President of Corporate Strategy. It is comprised of our management level, cross-functional subject matter experts, and offers division-specific knowledge and accountability as it relates to the ongoing development and evaluation of our ESG, and climate initiatives. One of the most frequent topics of discussion for this committee is our focus on energy transition and our renewable energy development strategy. ESG strategic risks are included in our overarching Enterprise Risk Management (“ERM”) program. TPL assigns an executive to manage and monitor the effectiveness of the processes and controls surrounding each strategic risk within the ERM program.

Strategy

Climate-Related Risks and Opportunities

Risks:

Our strategic approach to managing climate events represents a critical component of our broader, long-term business strategy at TPL. We are factoring in the risks and impacts of climate events to our economic, environmental, social, and governance decisions to ensure we remain committed to responsible operations.

As part of our ERM framework, TPL has identified the following examples of climate-related risks that could potentially impact our business:

Transition Risks

-

Legal and Regulatory Risks: The inability to anticipate and/or properly respond to changes in the regulatory environment could negatively impact TPL’s ability to create value for our stockholders. Changes to legislation or regulation related to a tax on production volumes, GHG emissions, or other environmental elements could lead to increased operating costs and/or reduction in profits.

-

Reputational Risks: Regardless of the source of reputational risks, any reputational damage to TPL has the possibility to impact our business in many ways and impact our relationship with numerous stakeholders. Reputational risks have the ability to negatively impact our brand and thus our relationship with customers, which can impact revenue generation. Beyond this, it can hurt our relationship with our employees and communities, which can impact our ability to sustain normal operations and grow as a company. Changing investor and lender sentiment about our reputation further has the potential to impact our access to capital or ability to attract new investors.

-

Technology and Market Risks: Technological developments will be a key component in energy efficiency. TPL recognizes that the evolution of global energy sources is partially affected by factors out of our control, such as the pace of technological developments and related cost considerations, the levels of economic growth in different markets around the world, and the adoption of climate related policies. The pace at which technology develops can impact TPL’s ability to operate more sustainably. Further, varying economic growth situations and climate policy evolutions can impact both the profitability and viability of our business in the long-term. TPL regularly monitors evolutions across these areas.

Physical Risks

-

Acute: Acute physical risks include possible abnormal changes in the severity and frequency of extreme weather events and natural disasters, both of which could disrupt TPL’s business. Extreme weather events have the possibility of impacting our service delivery, which could lead to lost revenue, missed opportunities, and strained client relationships. While this risk impacts our competitors as well, the specific geographic location of our land varies from competitors, which could mean facing different extreme weather situations.

-

Chronic: Chronic physical risks include possible abnormal changes in precipitation patterns and extreme variability in weather patterns, along with the gradual shifting in broader climate patterns. Chronic physical risks could include drought and aquifer decline within our business, therefore resulting in lost revenue and/or missed opportunities which could seriously disrupt our water business and impact revenues from the operators that rely on water resources to source oil and gas product. Additionally, other gradual but significant climate topics can impact the attractiveness of our land and thus our ability to generate revenue and increase shareholder value.

Opportunities:

We will continue to identify opportunities that improve our competitive advantage. One of the biggest opportunities for the Company is related to reducing our GHG emissions through a series of electrification projects. As these have been implemented, our expenditure on electrification has more recently been attributed to maintenance costs of our electrified assets.

Carbon Management- Carbon Capture and Sequestration Solutions

"Carbon capture can be a key tool in the quest for net zero, and TPL’s expansive surface footprint can serve as a key resource to permanently sequester carbon. We are constantly looking for ways to leverage the unique features of our surface assets, and carbon capture is an exciting opportunity that could serve a dual purpose of creating value for our shareholders while also benefitting the environment."

Tyler Glover, CEO of TPL

Our land acts as a carbon sequestration solution to permanently store the carbon that directly results from oil and gas operations. Due to the geological characteristics of our land, we can offer operators environmentally permitted pore space that is needed within or near the Permian Basin. Permanent sequestration is not possible without land that can offer this emissions management solution—that is exactly what we provide. In 2023, two major projects were signed and are currently underway to drive CCS.

Ozona CCS

In partnership with Ozona CCS, we reached an agreement to lease approximately 5,173 contiguous acres of land for the purpose of drilling one of the first CO2 sequestration wells in the Permian Basin. Ozona will build the long-term infrastructure solutions to capture, transport, and sequester CO2 to support the operators both on our land and in the region.

The acreage has an estimated initial injection rate of up to 25,000 barrels per day and an estimated total storage capacity of at least 40,000,000 metric tons of CO2. These partnerships may require a CO2 injection Monitoring, Reporting and Verification Plan, filed with the Environmental Protection Agency (EPA), to ensure the carbon remains sequestered.

Milestone Carbon, LLC

Since 2021, TPL has been working with Milestone Carbon to evaluate geological and geophysical characteristics of TPL’s land in order to sequester captured CO2. In 2023, the partnership was solidified. Milestone Carbon will lease more than 22,000 acres of land and pore space on TPL’s land for permanent geologic sequestration. The acreage, located in Loving and Midland counties, would support CCS projects at industrial facilities in West Texas, including natural gas processing and power plants.

As a landowner and water operator, our emissions footprint is minimal. Yet, we know we have a critical solution for the oil and gas entities that operate on our land to mitigate and reduce their own footprint. Carbon sequestration allows oil and gas companies to meet, or even outpace, their GHG emission reduction targets. Not only is this a feasible way for oil and gas operators to manage their direct emissions, it is also a smart business decision for TPL to provide these storage options. Incentives around sustainable energy projects, such as carbon capture, utilization, and storage (CCUS) enable our Company to act as stewards of the environment. As operators and consumers look to reduce the carbon intensity of fossil fuel products, carbon capture and sequestration projects will be necessary to produce and acquire these cleaner products. TPL views the energy transition as an economic and social opportunity to contribute to the protection of our land and environment.

Water Management

We formed Texas Pacific Water Resources (“TPWR”) in 2017 to support E&P companies’ operations by meeting demand for sourced and recycled water resources. We facilitate the development of infrastructure to provide water midstream services that enable the gathering, reuse, and recycling of produced water.

Our water recycling capabilities allow operators to minimize the use of freshwater resources, which is becoming an increasingly critical business strategy in Texas. The Company has also prioritized the electrification of our water assets to reduce reliance on diesel and to manage our emissions profile.

Notably, TPWR does not operate saltwater disposal wells (SWDs), but requires SWDs drilled on our property by third parties to meet industry and regulatory standards.

Environmental Management

TPL prioritizes critical environmental issues such as energy efficiency, emissions management, and ecological due diligence to minimize climate-related risks to our operations. These sustainability areas continue to remain a top priority for the Company in our forward-looking strategies and decision-making. We regularly look for more efficient technologies in our operations which enable us to not only reduce costs but also our impact on the environment.

Programs to Reduce Carbon Emissions

We track and monitor emissions across all of our water operations and undertake a variety of emissions reduction initiatives. Reducing our footprint is a focus of our environmental stewardship commitments, and we have made significant progress over the past few years through new strategic partnerships, asset retrofits and operational advancements that have enabled significant reductions in our emissions intensity and overall GHG footprint.

Electrifying our Operations

- The only operations TPL owns and manages are those of TPWR- our water resources company. These operations represent the largest opportunity for TPL to mitigate and reduce our carbon footprint through a series of electrification projects across our water assets. We conducted a thorough analysis of our water assets and prioritized the high-utilization, high-impact assets for electrification to remove the reliance on diesel, and thus a greater reduction in our carbon footprint. We continue to allocate capital and assess which projects are next in the electrification timeline. To date, we have spent $15.8M on electrification, and the impact of these retrofits is visible. Between 2020 and 2023 years, we electrified 86% of our assets, and after recalculating our footprint, saw our Scope 1 emissions drop 27%.

The 2021 Texas Freeze highlighted infrastructure vulnerabilities across the Permian Basin for both water management and O&G companies. Although electrification is the goal as a primary power source, TPL has diesel generators as backups for all assets to ensure operations continue to run in an emergency power-outage scenario.

Energy Efficiency

- TPL has processes in place to track energy consumption (electric and diesel) by location, covering approximately 80% of the energy used.

- TPL purchased electrical pumps to move water which decreases our diesel usage, thus minimizing our carbon footprint.

- TPL has long used auto-shutoff lights in an effort to conserve energy and improve our energy efficiency.

Renewables and "Next-Gen" Development

Not only are we focused on our own emissions profile, we are also enabling oil and gas operators to reduce their emissions footprint. We feel that our land holding uniquely positions us to promote and inspire innovation across the clean energy market and support the energy transition.

In an effort to continually adapt to market opportunities and diversification strategies, TPL has a “next-gen” team that solely focuses on encouraging wind and solar development on our properties and exploring all available options to increase our existing renewable footprint. The team strategically prioritizes increasing our existing renewable portfolio through industry outreach and a thorough understanding of regulatory considerations and infrastructure requirements.

For example, we are working with our current partners across the Permian Basin to implement micro-grid sized projects (typically 5-50MW) that will allow traditional O&G companies to reduce their own carbon footprint by supplementing grid power with cost-efficient and reliable green energy.

TPL also allows for easements on our land to construct electricity infrastructure, supporting oil and gas operators’ access to electricity and thus avoiding the use of diesel to power their operations. This supports a tremendous amount of emissions reductions from operators across TPL’s land. Currently, we host around 120MW of wind power and our land holdings play a critical part in supporting infrastructure related to an additional 100MW of solar power. We partner with developers who can create over 100 MW of commercial-grade projects by executing long-term purchase power agreements (PPA). We are also working with our current partners across the Permian Basin to implement micro-grid sized projects (typically 5-50MW) that will allow traditional O&G companies to reduce their own carbon footprint by supplementing grid power with cost-efficient and reliable green energy.

Our unique operating model allows us to pursue opportunities to increase our renewable portfolio. Energy produced by our renewable operations can be sold back to the grid or used to offset our own electricity consumption. TPL’s contracted renewable production at the beginning of 2023 was 166MW. As of December 31, 2023, TPL contracted an additional 510MWs, representing a 307% increase year over year. Of these newly contracted agreements, project sizes ranged from 200MWs to 10MWs. In 2022, we increased contracted renewable energy capacity by 37%. In 2021, we executed an agreement with Texas A&M AgriLife Extension to begin assessing soil carbon sequestration opportunities across a couple land plots spanning approximately 20,000 acres. Our objective with this project was to further understand the environmental benefits our surface assets offered.

Risk Management

Our ERM framework includes an assessment of vulnerability to enterprise risks and lays out a Risk Mitigation Plan for each risk, including the examples of climate change related risks identified in the “Strategy” section. The executive management team member or delegate assigned to each risk mitigation plan is responsible for advancing key solutions, including those for climate-related risks. By incorporating climate-related risks to our ERM strategy, we are able to proactively track and monitor the various risks that can result in material, destructive impact to our operations, financials, and reputation.

We have processes and protocols in place to monitor the potential impacts of climate-related risks on our own operations, which are part of our broader risk management program. While the nature of climate-related risks, and risks in general, is complex, we use the following matrix of frequency and probability as a starting point to assess critical risks to our business.

| Rating |

Annual Frequency |

|

Probability |

|

|

Descriptor |

Definition |

Probability |

Definition |

| 5 |

Very Likely |

Up to once in 2 years or more |

Almost Certain |

90% or greater chance of certain occurrence over life of asset, project or company. |

| 4 |

Likely |

Once in 2 years up to once in 10 years |

Likely |

65% up to 90% chance of occurrence over life of asset, project or company. |

| 3 |

Possible |

Once in 10 years up to once in 25 years |

Possible |

35% up to 65% chance of occurrence over life of asset, project or company. |

| 2 |

Unlikely |

Once in 25 years up to once in 50 years |

Unlikely |

10% up to 35% chance of occurrence over life of asset, project or company. |

| 1 |

Rare |

Once in 50 years or less |

Rare |

<10% chance of occurrence over life of asset, project or company. |

These identified risks are accompanied by critical information about root causes and potential impacts in order to facilitate discussions of applicable, actionable, and measurable mitigation plans. Throughout the year, TPL assesses and defines the potential material risks to our business and allocates risk ownership accordingly to an executive member or team, which updates the ERM document accordingly. Our ERM program is managed by the executive management team and overseen by the Audit Committee of the Board of Directors.

The following criteria is used in assessing risks identified by management, including climate-related risks:

Impact: Impact (or consequence) refers to the extent to which a risk event might affect the enterprise.

Likelihood: Likelihood represents the possibility that a given risk event will occur expressed using qualitative terms as frequency or percent probability.

Velocity (Speed of Onset): Velocity or Speed of Onset refers to the time it takes for a risk event to manifest itself, or in other words, the time that elapses between the occurrence of an event and the point at which the company first feels its effects.

Vulnerability: Vulnerability refers to the susceptibility of the entity to a risk event in terms of criteria related to the entity’s preparedness, agility, and adaptability.

Beyond identified risks, our ERM Assessment also works to identify and mitigate emerging risks, as TPL is aware that risks can either gradually emerge over time or present themselves overnight. The ERM is embedded into every aspect of our business decision-making to deliver enhanced and predictive returns for our shareholders. This process includes assessing legal/compliance obligations, the energy transition, potential natural disasters, extreme weather events, and more.

Specifically,

- TPL’s full Executive Leadership Team and Board regularly monitor and discuss the evolving political and regulatory environment around potential emerging risks from pending or changing legislation or regulations.

- TPL navigates potential reputational risks by striving for continuous improvement within our operations, while also regularly engaging with various stakeholders to understand and internalize their perspectives and opinions. This drive for continuous environmental performance improvement is part of our efforts to protect our reputation as a responsible operator. Meanwhile, our commitment to stakeholder engagement enables us to monitor evolving expectations from employees, suppliers, customers, investors, landowners, and our communities. For example, some of our landowner relationships have existed more than 100 years, and their expectations from TPL have changed over time. We regularly engage with them, and other stakeholder groups, as part of our process to manage reputational risks.

- TPL has a culture of continuous improvement across all of our teams, and this culture shows itself in our approach to innovative technology. One key component of this is that we regularly assess evolving technologies that have the capability to change an industry or help improve the environmental efficiency of our operations. We have implemented advanced technologies in our operations, such as the electrification of assets, and proactively work to remain informed of new technological opportunities.

- Market trends present both a risk and opportunity for TPL, which we navigate in several ways. Our finance department regularly assesses economic trends to predict their impact on our business. Specific to climate change, our business is positioned to support companies who are part of the climate solution, both by encouraging the electrification of assets and, importantly, being able to lease our land to providers of renewable energy.

- TPL also works diligently to monitor and mitigate physical risks. For acute risks, TPL works with our lessees to encourage and focus on the resilience of our operations and their operations, being able to withstand extreme weather conditions to the extent possible. Further, for chronic climate risks, TPL analyzes these trends both in the context of where our assets are located and the environmental responsibility of our lessees.

Metrics and Targets

Metrics Used to Assess Climate Risks and Opportunities

Quantitative data enables us to track and meaningfully manage climate change risks and opportunities. Our metrics and KPIs provide a foundation to guide the company’s current and future strategic business decision-making. We view the tracking and disclosing of environmental performance data as a first key step towards systematically approaching climate risk management. 2023 data is tracked and disclosed below. TPL remains dedicated to the continued aggregation and analysis of this data to monitor and trend our progress against our baseline.

At TPL, we use Scope 1, Scope 2, total energy consumed (GJ), percentage of energy type and electrification to assess climate-related risks and opportunities in line with our strategy and risk management process.

Metrics:

Scope 1 and Scope 2 GHG Emissions (2023)

Scope 1 = 13,819 Metric Tonnes CO2e *from TPL and TPWR operations*

Scope 2 = 10,572 Metric Tonnes CO2e *from TPL and TPWR electricity consumption*

Total Scope 1 and 2 = 24,391 Metric Tonnes Co2e *calculation applies EPA’s 2024 Emissions Factors for Greenhouse Gas Inventories

Target:

Additionally, as mentioned earlier, TPL committed to a major goal of increasing contracted renewables by 30% by 2023, which was achieved by increasing the starting value of 166 MWs at the beginning of 2023 to 510MWs at the end of 2023. *

*Factors that could impact the goal include material costs, access to capital, and grid constraints.

Forward-looking Statements*

This presentation contains certain forward-looking statements within the meaning of the U.S. federal securities laws that are based on TPL’s beliefs, as well as assumptions made by, and information currently available to, TPL, and therefore involve risks and uncertainties that are difficult to predict. These statements include, but are not limited to, statements about strategies, plans, objectives, expectations, intentions, expenditures and assumptions and other statements that are not historical facts. When used in this document, words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and “project” and similar expressions are intended to identify forward-looking statements. You should not place undue reliance on these forward-looking statements. Although we believe our plans, intentions and expectations reflected in or suggested by the forward-looking statements we make in this presentation are reasonable, we may be unable to achieve these plans, intentions or expectations and actual results, performance or achievements may vary materially and adversely from those envisaged in this document. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see TPL’s annual report on Form 10-K and quarterly reports on Form 10-Q filed with the SEC. The tables, graphs, charts and other analyses provided throughout this document are provided for illustrative purposes only and there is no guarantee that the trends, outcomes or market conditions depicted on them will continue in the future. There is no assurance or guarantee with respect to the prices at which the Company’s common stock will trade, and such securities may not trade at prices that may be implied herein.

TPL’s forecasts and expectations for future periods are dependent upon many assumptions, including the drilling and development plans of our customers, estimates of production and potential drilling locations, which may be affected by commodity price declines, the severity and duration of the COVID-19 pandemic and related economic repercussions or other factors that are beyond TPL’s control.

These materials are provided merely for general informational purposes and are not intended to be, nor should they be construed as 1) investment, financial, tax or legal advice, 2) a recommendation to buy or sell any security, or 3) an offer or solicitation to subscribe for or purchase any security. These materials do not consider the investment objective, financial situation, suitability or the particular need or circumstances of any specific individual who may receive or review this presentation, and may not be taken as advice on the merits of any investment decision. Although TPL believes the information herein to be reliable, the Company and persons acting on its behalf make no representation or warranty, express or implied, as to the accuracy or completeness of those statements or any other written or oral communication it makes, safe as provided for by law, and the Company expressly disclaims any liability relating to those statements or communications (or any inaccuracies or omissions therein). These cautionary statements qualify all forward-looking statements attributable to us or persons acting on our behalf.